Failure of Russia-Ukraine talks spurs wheat price headway

• Latest Russia-Ukraine peace talks end after only two hours

• Encourages return of risk premium into wheat prices

• Rapeseed hits six-month high, before profit-taking sets in

Wheat prices gained as the failure of the latest peace talks between Russia and Ukraine, two of the biggest exporters, revived supply concerns, besides helping a rally in oil prices which fuelled rapeseed market volatility.

Peace talks in Geneva between Ukraine and Russia ended after only two hours, and without a breakthrough. Both the chief Russian negotiator and Ukraine President Volodymyr Zelensky termed the session “difficult”.

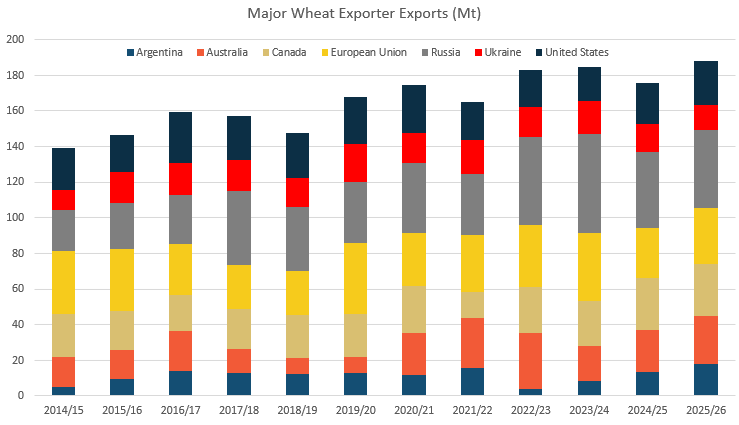

The lack of progress on peace between two countries which between them account for more than one-quarter of world wheat exports encouraged a reinjection of risk premium into prices of the grain.

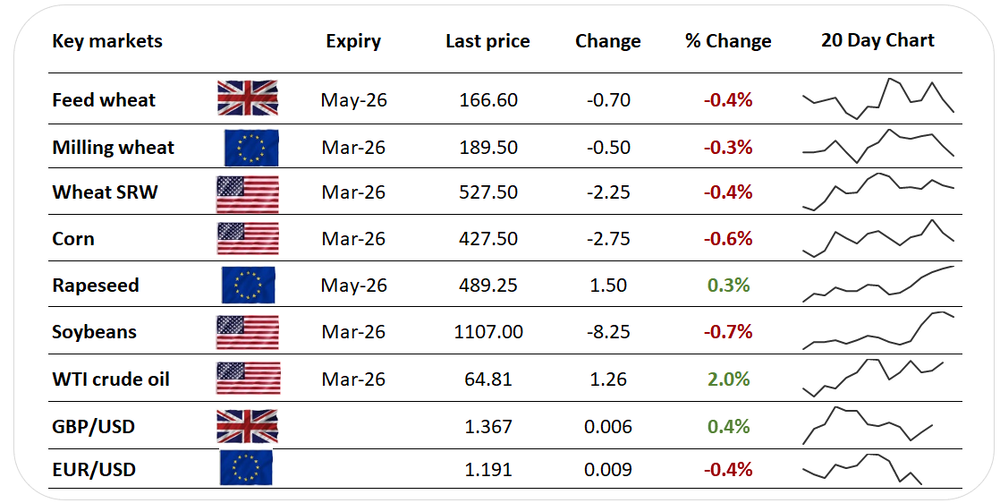

Buying was encouraged too by a broader recovery in commodities, including crude oil, which attracted extra support from fresh concerns over US-Iran relations, on a report that Iran was to conduct navy drills with Russia in the Sea of Oman and the northern Indian Ocean on Thursday.

Brent crude added 3.5% in late deals to trade just short of $70/Bbl, with the Bcom commodities index gaining 1.9%, helped by recoveries in precious metals as well as many ags too.

Iran on Tuesday shut the Strait of Hormuz - a key transport route for oil and other commodities, including ags - for “security precautions” during drills by its Revolutionary Guard.

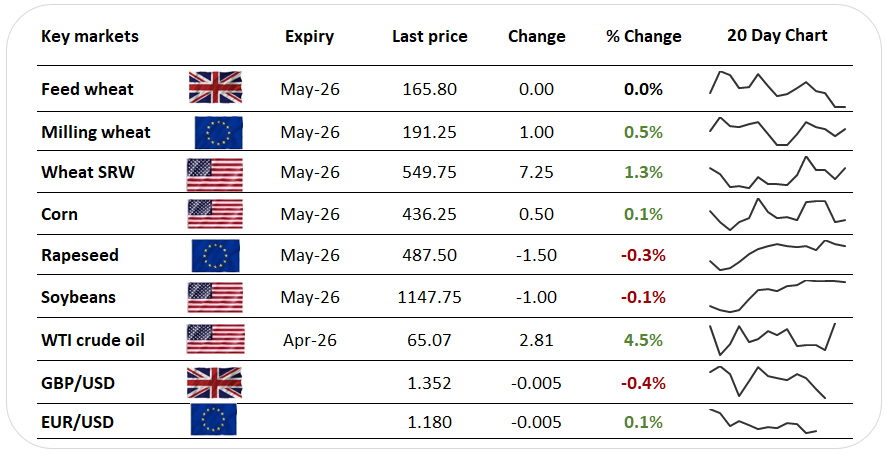

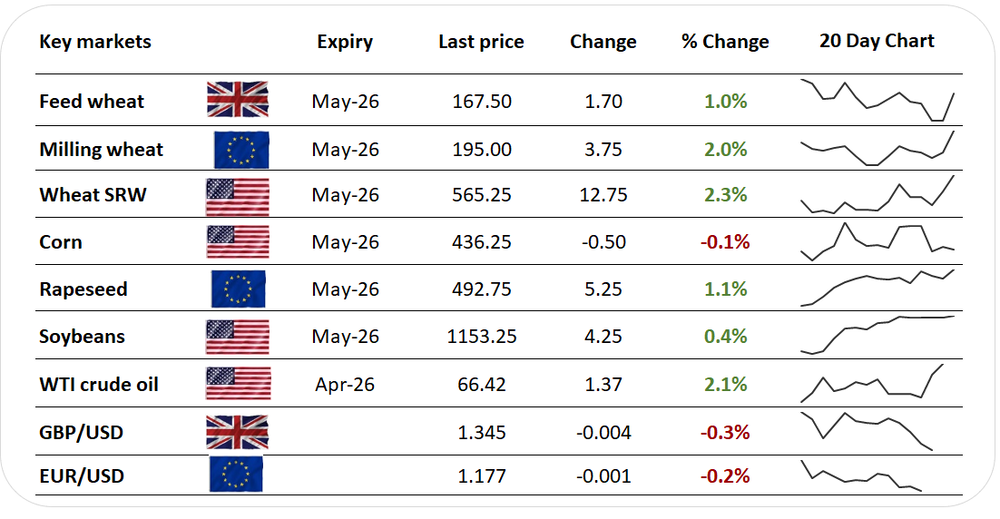

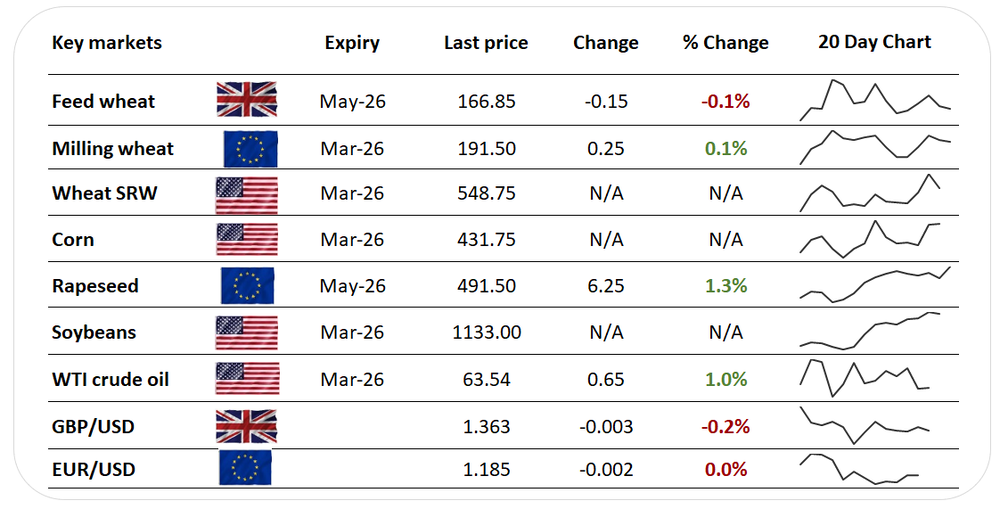

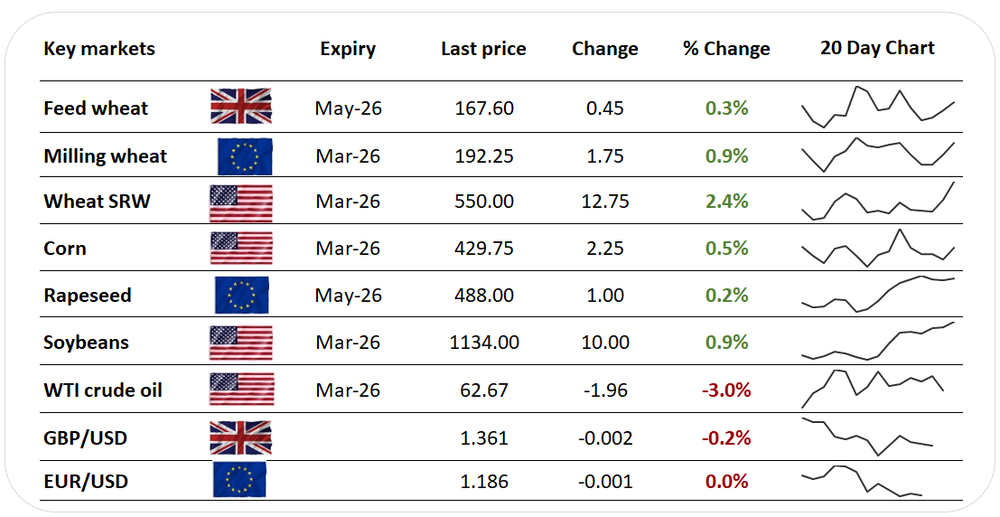

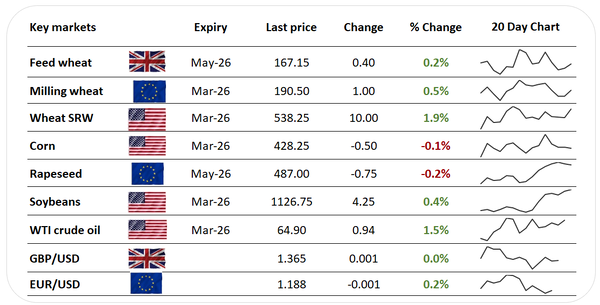

Wheat futures for May-26 gained 1.1% in late morning deals in Chicago, before running into resistance at the $5.50/Bu mark, and despite the headwind of a strengthening dollar.

The greenback rose by 0.4% against a basket of currencies, on official data showing better-than-expected data on US manufacturing output and capital goods orders.

European wheat contracts again lagged Chicago, despite the advantage of weaker currencies.

Paris milling wheat for May-26 traded up 0.5% in late deals, while London feed wheat for November-26 stood unchanged.

Rapeseed futures for May-26 traded a volatile session, rising to a six-month high of €495/t before dipping on profit-taking. The lot settled 0.3% down, below the key €490/t level.

The contract found support early on from a strong soyoil market, as well as the headway in crude oil prices. Chicago soyoil futures for May-26 set a contract high above $0.59/lb, encouraged by talk of further progress on revised US biodiesel rules.

However, rapeseed faces resistance from tight European crush margins, and a seasonal upswell in imports from Australia.