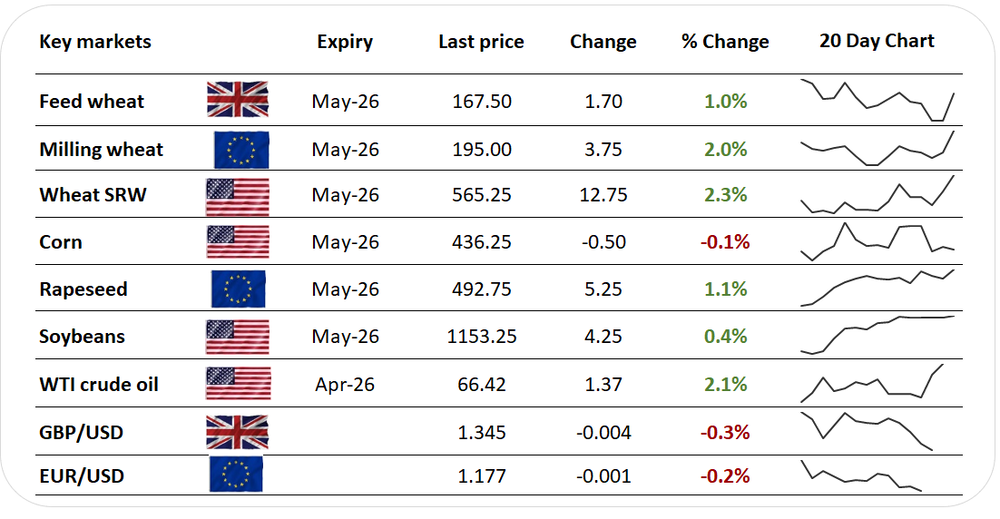

Wheat futures gain as USDA forecasts unusually small sowings

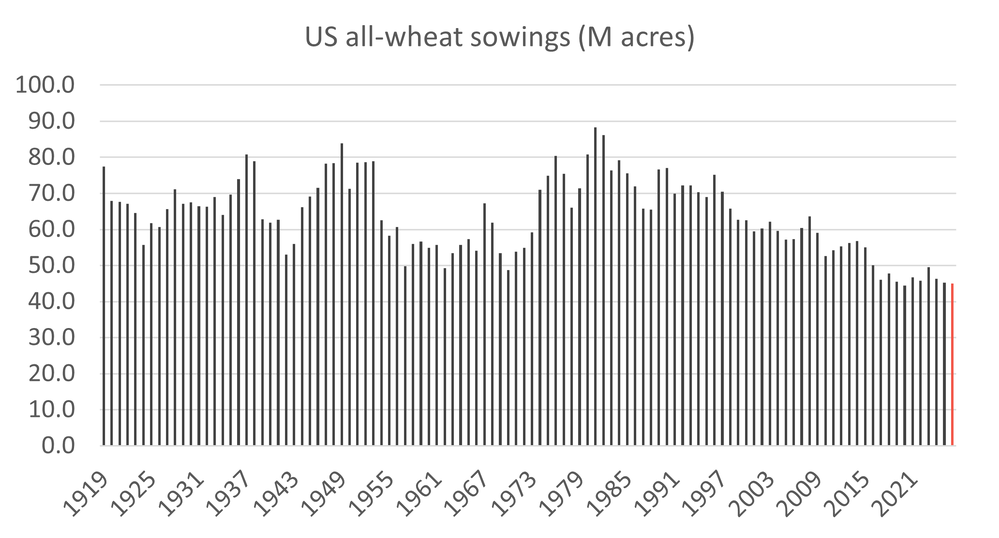

• USDA forecasts US wheat sowings at the second smallest in more than a century

• Dryness an issue too, encouraging further short-closing by funds, traders say

• Corn to lose 2026 area in US too, although soybean plantings to expand

• Brent crude hits $72/Bbl for first time in six months, on US-Iran tensions

• Helps rapeseed prices back above €490/t in Paris

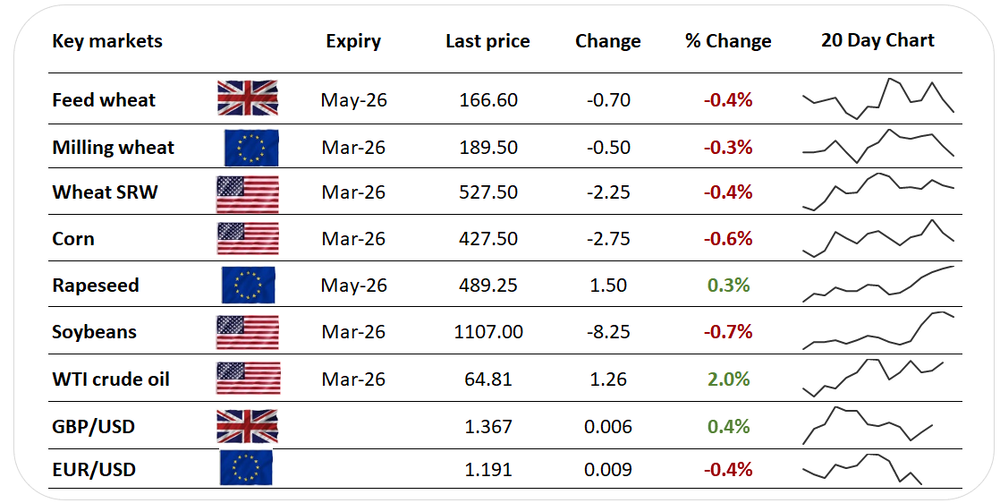

Wheat futures leaped in Chicago, as dryness concerns and a USDA forecast for the second smallest sowings in more than a century enhanced ideas of a weaker US harvest this year, helping headway in European prices too.

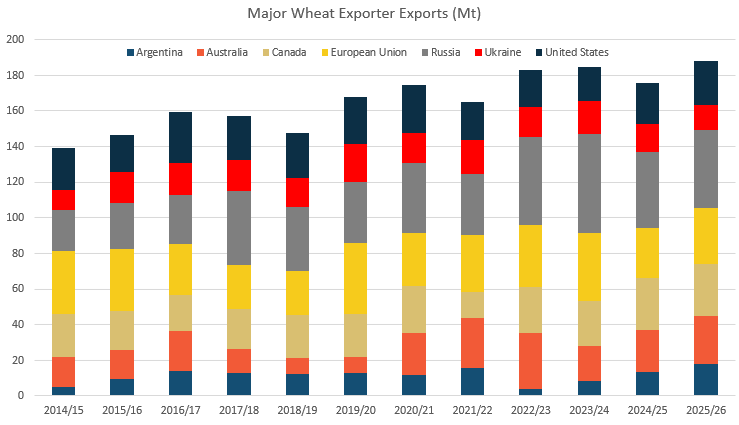

The USDA, in initial 2026/27 US crop estimates unveiled at its annual Outlook Forum, forecast US wheat sowings falling by 300K acres year on year t0 45.0M acres - the second smallest area on data going back to World War I. (The USDA unveiled its first US winter wheat area estimate last month.)

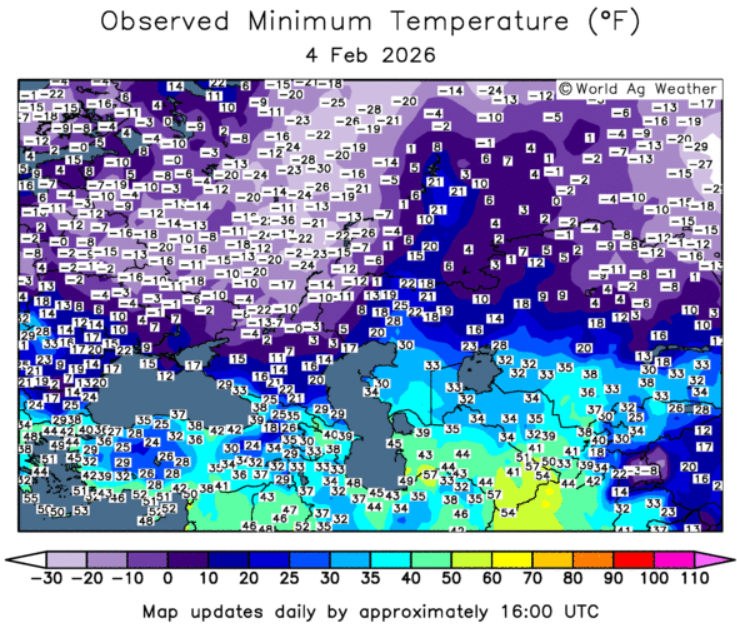

Output was forecast falling by 3.4Mt to 50.6Mt, a three-year low, based on a yield calculated from “a long-term linear trend”. Ideas of a production dip were enhanced by weather maps showing at least a fortnight of clear skies in the US Plains, a key winter wheat-growing region, where dryness is already provoking crop concerns.

The USDA last week estimated 45% of US winter wheat area in drought, up from 23% a year before.

The concerns were reported to be encouraging further short-closing by funds, a trend believed to be fuelling a tumble in open interest in Chicago wheat futures, which has shrunk by more than 70K contracts in two weeks, to 472K contracts.

Separately, the International Grains Council said that "the initial global wheat supply and demand outlook appears slightly tighter in 2026/27, with expectations for a reduced harvest and further consumption gains".

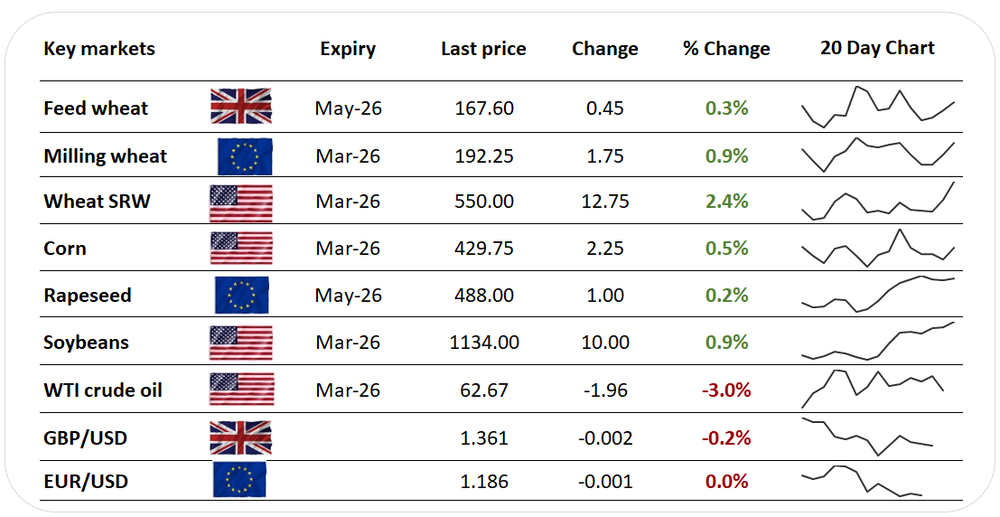

Chicago soft red winter wheat futures for May-26 traded 2.2% higher in late morning deals, helping Paris milling wheat for May-26 gain too, by 2.0% in late deals to hit €195/t for the first time since November. The Paris contract topped its 100-day moving average for the first time since March last year.

London feed wheat for May-26 settled up 1.0%, back above its 20-day moving average.

Rapeseed rose too in Paris, by 1.1% in late trading to return above €490/t. The oilseed was supported in part by further gains in Chicago soyoil, which for May-26 futures closed in on $0.60/lb for the first time since September 2025.

Further headway in crude oil prices, supported by concerns over US-Iran tensions, attracted buying too to an oilseed used largely in making biodiesel. Brent crude traded 2.1% higher at $71.82/Bbl, and earlier touched $72/Bbl for the first time since the start of August.

Soybeans for May-26 gained a more modest 0.4% in Chicago, although this was sufficient to return the contract above the $11.50/Bu mark.

The market remains supported by hopes of Chinese buying of US supplies, although exuberance was tempered by a USDA forecast at its Outlook Forum of US soybean sowings rebounding by 3.8M acres to 85.0M acres this year.

The USDA said its forecast, which fed through into an estimate for US stocks to change little over 2026/27, reflected “stronger profitability compared to other crops”.

Corn futures for May-26 eased by 0.2% in Chicago. The USDA forecast US corn sowings this year sliding by 4.8M acres to 94.0M acres, a figure in line with market expectations.