Wheat, buoyed by short-closing, bucks share, oil market selldowns

• Grain markets buoyed by report of China, US talks on extended trace truce

• Wheat futures jump to highest in nearly three months, supported by short-closing

• Crude oil slides on upgraded IEA forecast for 2026 supply surplus

Grains, led by wheat, defied a negative session on many markets, as hopes grew of an extended US-China trade truce.

Stock markets attracted selling, blamed on concerns over disruption to corporates from artificial intelligence, as well as concerns over returns to tech companies from AI spending. New York’s S&P 500 index shed 1.3% in lunchtime deals.

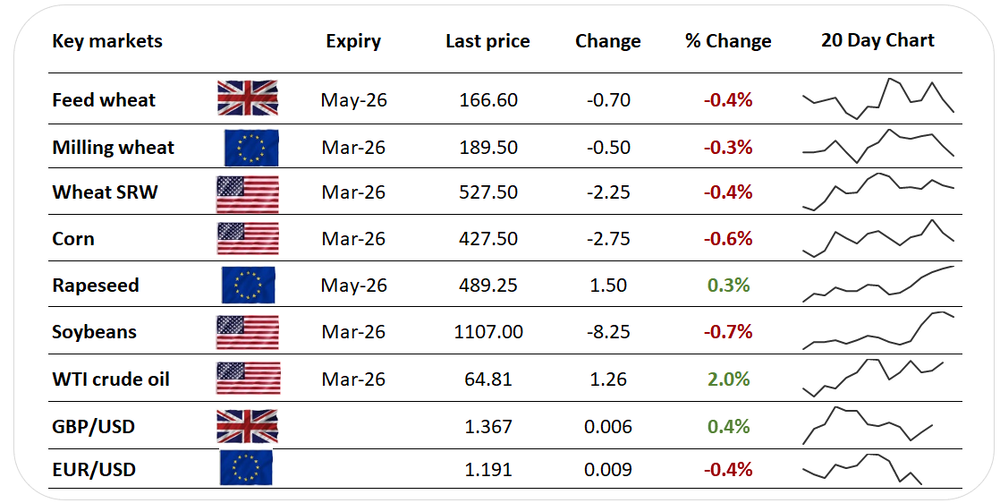

Commodities retreated too. The Bcom index shed 1.4%, spurred by 2.9% dip in Brent crude, after the, International Energy Agency lowered its global oil demand forecast for 2026, foreseeing a supply surplus of 3.7M barrels per day.

“Economic uncertainties and higher oil prices" are weighing on consumption, the IEA said.

However, grains posted widespread headway, encouraged in part by a South China Morning Post report that Beijing and the Washington are in talks over rolling back tariffs for up to a year, a move which would encourage trade between China, the world’s top ag importer, and the US, one of the largest exporters.

It is expected that an agreement will be announced during US President Donald Trump’s visit to China, as starts at the end of next month.

Soybeans, which are particularly exposed to US-China trade, found support, adding 0.9% in Chicago for March-26 delivery.

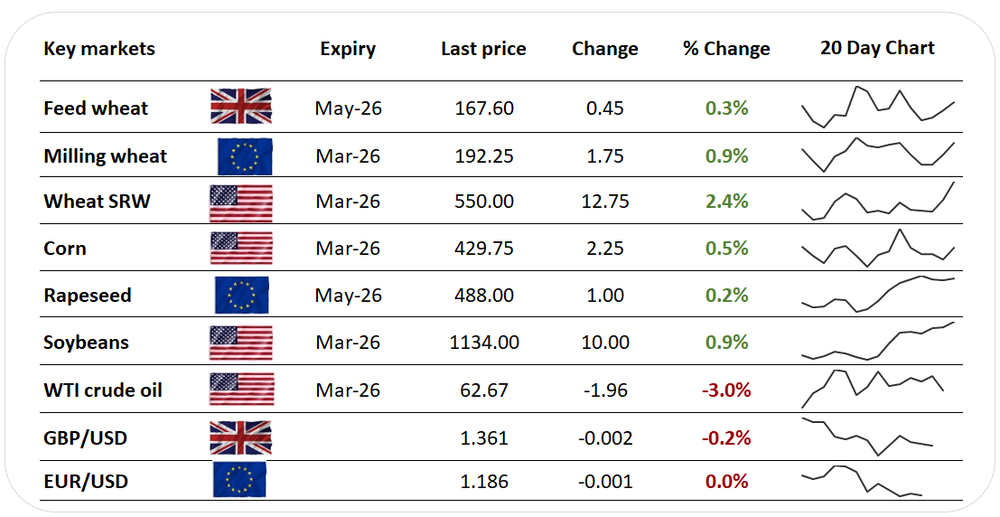

However, wheat led the charge, adding 2.4% in Chicago for March-26 to hit its highest level in nearly three months, as the US-China hopes encouraged short-covering by funds.

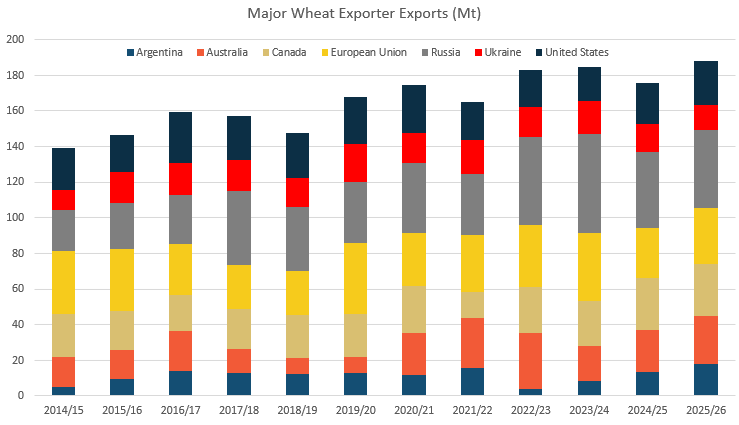

Furthermore, there are ideas that China’s wheat imports are poised to increase, given the growing price competitiveness of imports against rising domestic prices, and amid mounting talk of the country boosting feed grain purchases.

US wheat export sales last week, at 488Kt, came in towards the upper end of the range of market forecasts.

Paris milling wheat for March-26 settled up 0.9%, rising above its 20-day moving average. London feed wheat futures for May-26 added 0.3% before hitting resistance at their own 20-day moving average.

Paris rapeseed futures for May-26 settled up 0.2%, but below seven-month highs hit earlier for a spot contract, weighed by the retreat in crude oil prices, as well as finding resistance at the €490/t level.