Gold prices surge to record levels

- Gold surges to new record

- Oil prices rally on cold weather an geopolitical risks

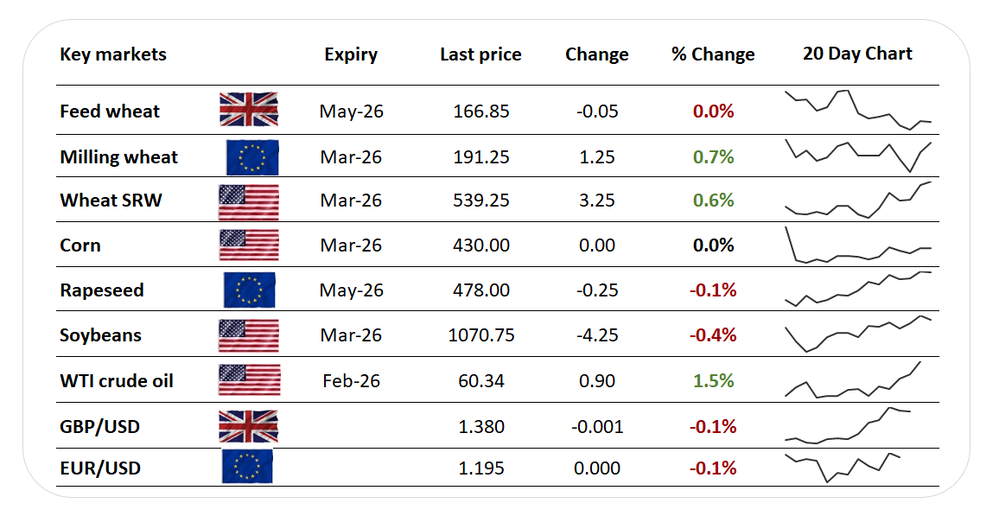

- European grain prices struggle amidst currency

The US dollar stabilised today after the Federal Reserve elected to keep interest rates unchanged at yesterday’s meeting. The devaluation of the world’s reserve currency so far in 2026 has continued to pressure European grain values.

Soymeal prices have strengthened recently as funds covered short positions, similar to activity seen in CBOT wheat, partly driven by the weaker dollar.

Meanwhile, increasing geopolitical risks have pushed investors toward safe-haven assets, with gold soaring over 20% in January to record highs above $5,300 (see chart below). Analysts are now suggesting that $6,000 is possible this year.

The surge in capital flowing into precious metals has pulled investment away from other commodity classes, including grains.

Oil values have also rallied above $65/bbl as Trump’s “armada” nears Iran, and freezing weather has contributed to a 2.3 million‑barrel decline in US crude inventories, according to the EIA.

Trump added support to grains by voicing support for E-15 ethanol demand whilst in Iowa, urging congress to support year round ethanol sales.

Extreme cold weather is expected to return to Ukraine next week, with up to -30 c forecast, which could pose a threat to crops without sufficient snow cover.

Overall, commodities remain in a geopolitical risk‑on phase, although global supply dynamics continue to paint a more mixed picture.