Europe's barley rally squares up to seasonal headwinds

EU barley prices may struggle to retain their recent buoyancy

Europe’s barley price rally may be getting long in the tooth.

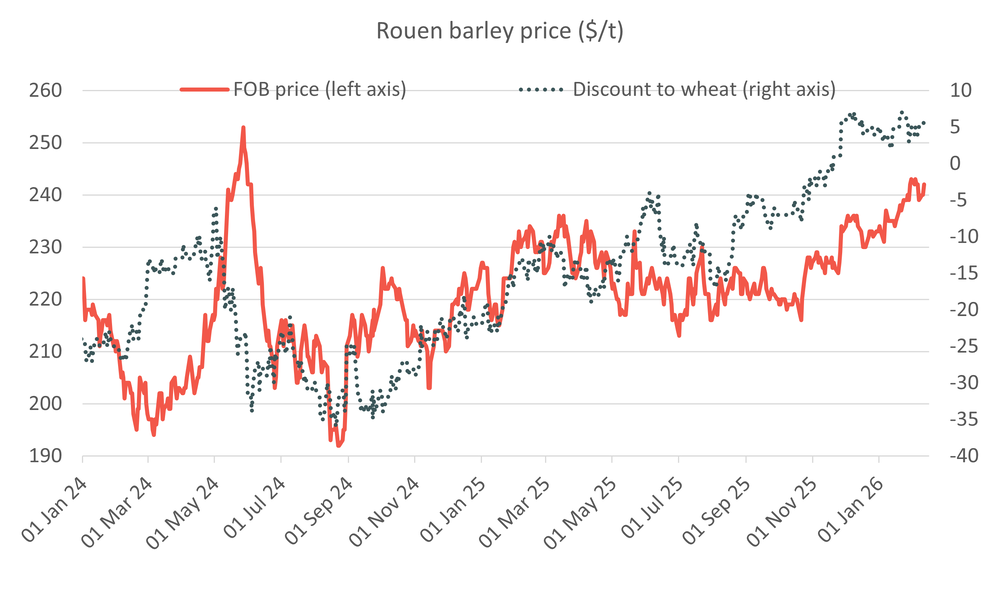

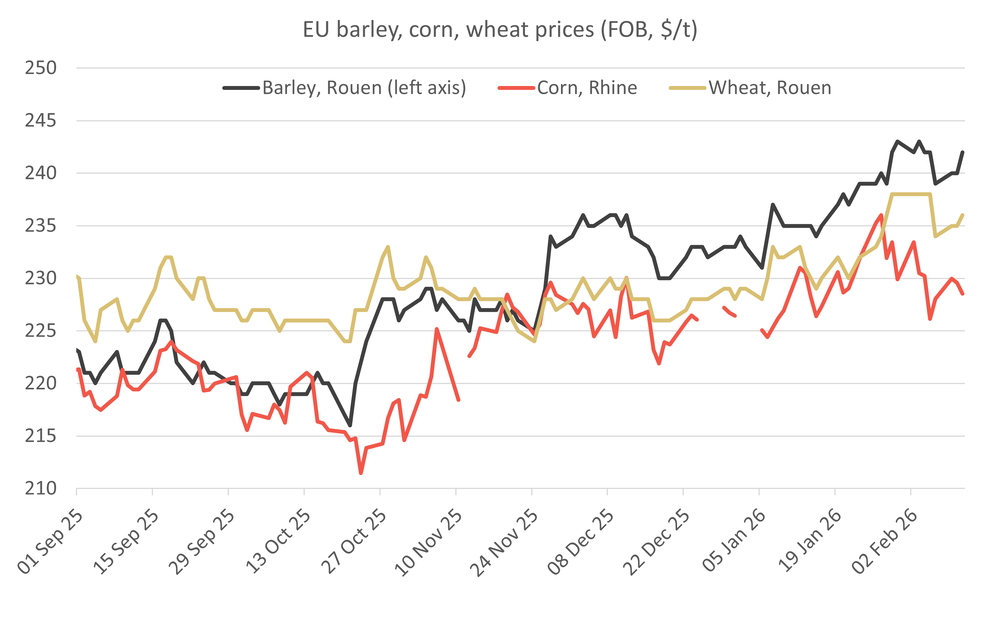

Barley prices in Europe have been unusually strong in 2025/26, and are exceeding $240/t in the benchmark Rouen, French market for the first time since June 2024.

The buoyancy has lifted them to an unusual premium to milling wheat.

However, despite indications of strong international demand - with Tunisia and Turkey buying at tenders this week and Jordan in the market too - two headwinds are emerging to further progress.

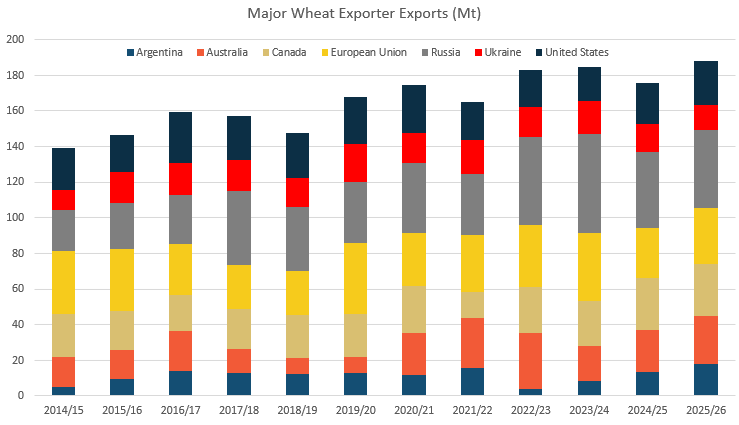

The first is from enhanced competition on export markets, now that the southern hemisphere harvests are in the barn.

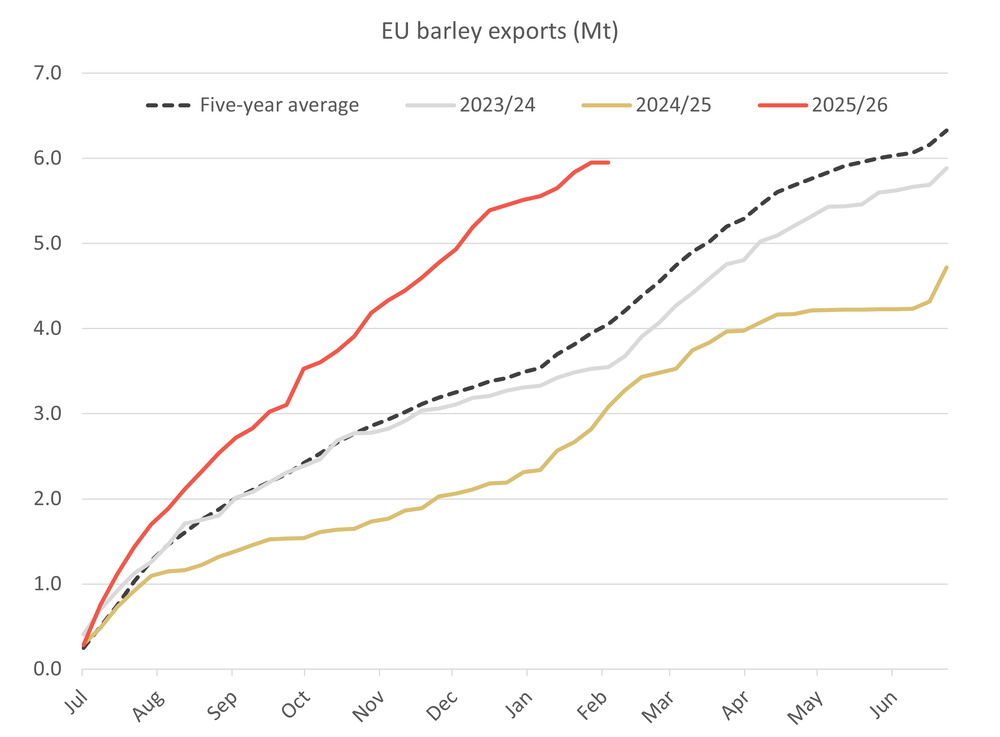

The EU’s strong barley export pace has been a key support to prices. Shipments had, as of 9 February reached 6.0Mt, up 93% year on year, EU Commission data show.

However, just as for wheat, the international barley market is now absorbing bumper Argentine and Australian crops.

Argentina’s 2025/26 barley exports are forecast by the USDA hitting a record 3.9Mt. Strong vessel line-ups at Argentine ports indeed indicate strong demand for a record 5.6Mt harvest - of which farmers have been ready sellers of too, reportedly having sold 80% of their harvest already.

Meanwhile, Australia, the world’s top barley exporter, is expected to see its highest-ever 15.5Mt harvest support shipments of 8.6Mt, the second largest on record.

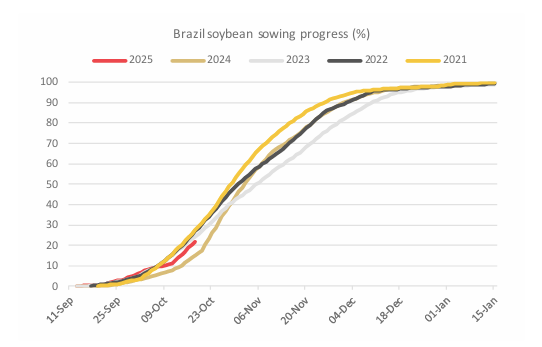

Australian prices below $240/t are already winning demand. China has reportedly been taking 1Mt of Australian barley a month since December, even has its purchases from the EU have stalled.

The EU, having exported 881.8Kt of barley to China in the first half of the season, ie July-to-December, has shipped just 7.2Kt since, commission data show.

This is reflected too in a slowdown in the EU’s overall weekly export pace to less than 100Kt over the past four weeks, from nearly 200Kt pre-Christmas.

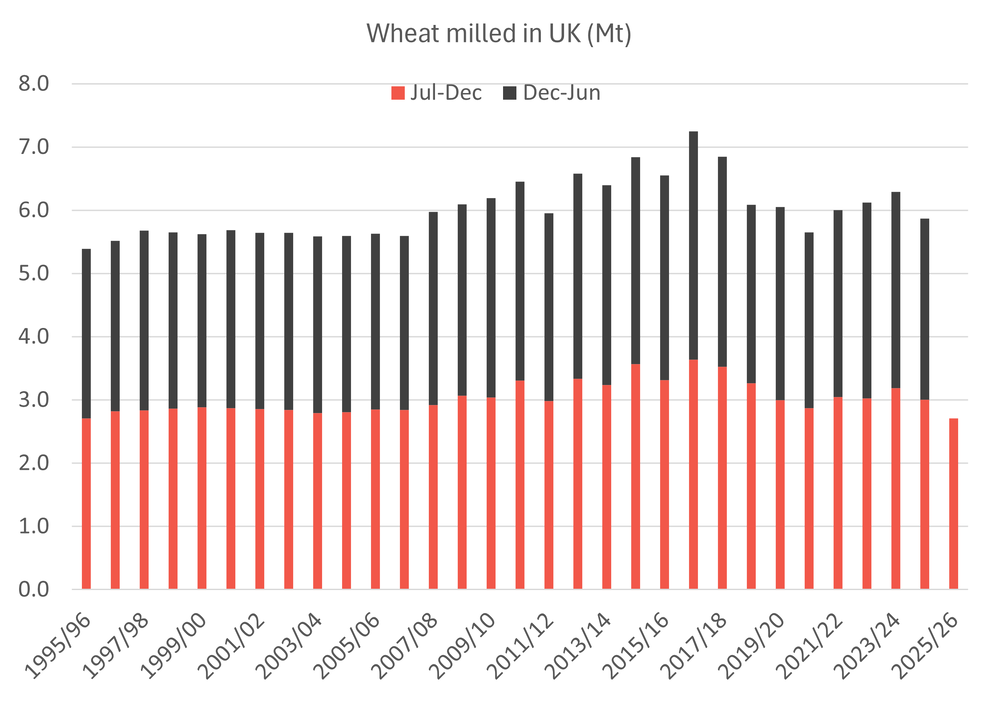

Furthermore, in the EU market, barley is losing support. While feed barley is usually priced with reference to feed wheat, it is in fact corn against which its prices have moved more closely this season.

The correlation of Rouen barley prices to Rhine corn, at 71% over the past six months, is not perfect, but it is closer than the 52% reading versus Rouen wheat.

With signs that EU corn prices are stabilising, as Ukraine exports accelerate, and with the prospect of a substantial Argentine crop to come, barley’s rally may run into thinner air.

This is not to suggest that a price crash is in the offing. The return of Algeria to buying French barley, and expectations of a fall in EU output this year, assuming yields retreat to average levels, are among factors reducing downside risk.

The likes of logistical upsets to Ukraine’s corn exports from Russian attacks, or heat damage to Argentine corn, may lift EU feed grain prices too.

However, current prices will recover a shift higher in either corn or wheat prices if the rally is to be sustained, neither is on the cards as it stands.