Weekly Oilseeds Outlook

| Bullish factors | Bearish factors |

|

|

|

Rapeseed opinion

Despite the recent tailwind for rapeseed prices, underpinned by geopolitics due to trade restrictions between Canada and China, rapeseed stocks in Canada remain abundant and RSI (relative strength index) levels are in ’overbought’ territory (see chart below). The risk of a sell-off has increased, without fresh fundamental support.

Rapeseed futures are, after breaking above resistance at their 200-day moving average, testing the solidity of resistance at the €490/t mark, and six-month highs.

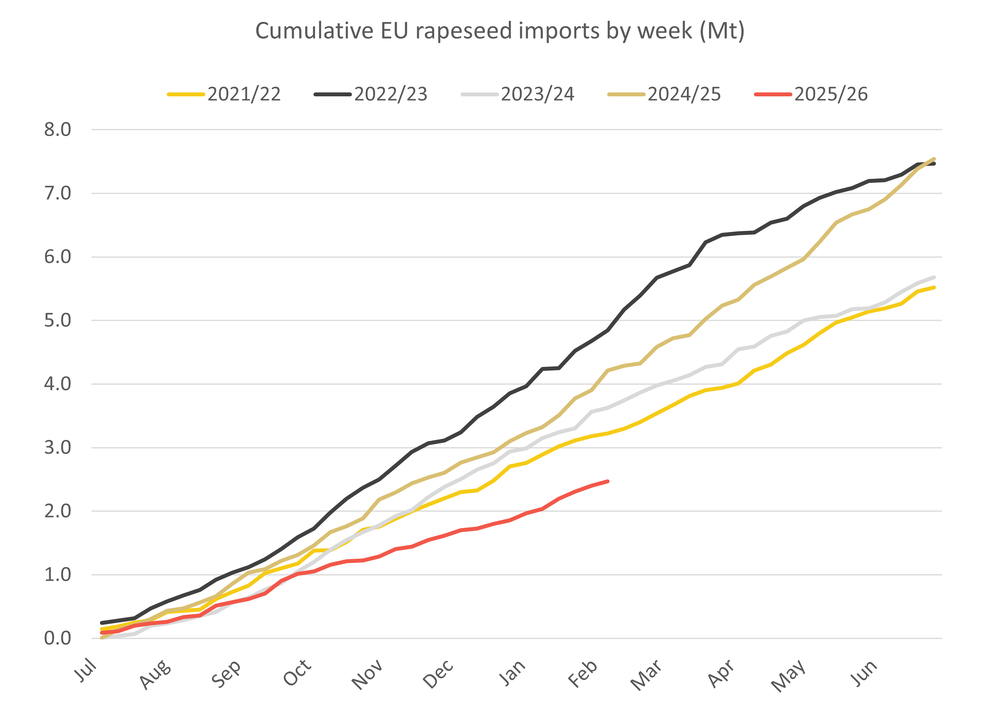

The headway retains support from the slow pace of EU imports. At 2.5Mt so far in 2025/26 they are running more than 40% slower than last season’s record pace.

This is keeping the door ajar to imports from Canada, which are continuing to find support from the reopening of China’s import market.

It is encouraging imports too from Australia which are, at $550/t FOB in Port Adelaide, at a discount of more than $30/t to FOB values in Moselle, France. EU imports from Australia, which had reached 190Kt in the first half of 2025/26, have now topped 500Kt, with the seasonally strongest period for volumes ahead.

Indeed, that looks one factor which may make further headway difficult for rapeseed prices.

Another is the relatively gentle rise in rapeseed oil prices. Their gain of less than 3% so far in 2026 in the benchmark German market is well behind the 7.8% headway in May-26 Paris futures, suggesting curtailed crush margins.

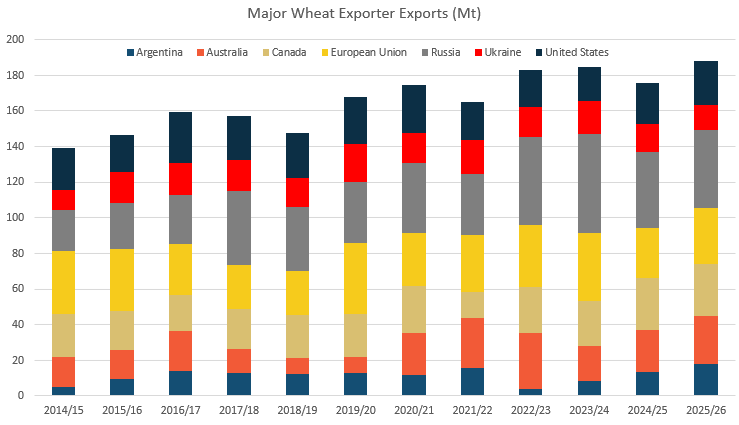

Last week’s USDA Wasde report hardly spoke of squeezed 2025/26 rapeseed supplies either, after strong harvests in Australia and Canada, the top two exporters, if less so in Ukraine, the third-ranked shipper.

Stocks in these three exporters were forecast closing the season at 4.5% of world use, representing the most ample supplies in six years. (In volumes terms, inventories will hit a seven-year high of 4.1Mt.)

The prospect of such supplies suggest resistance to further gains in Paris prices, although the extent of geopolitical unpredictability of course offers scope for substantial volatility. Rapeseed prices are exposed to vegetable oil prices and in turn biodiesel markets, which are vulnerable to political change, as well as to crude oil.

Prospects for harvest-26 will also soon start taking an increasing profile. Currently, expectations are high for the EU crop, seen as likely to exceed 20.0Mt again, while Canada has, in its first forecast for 2026/27, forecast a 270Kha rise to 8.9Mha in its plantings citing factors such as “crop rotation considerations” and “waning prices for other crops”.

For the UK, an extra price consideration is news of operational restrictions at ADM’s Erith crushing plant. This is supporting UK values of rapemeal, if on the face of it negative for prices of rapeseed itself. However, pressure on rapeseed prices may be diluted somewhat by the UK’s status on net imports, which may be first to take the hit.

Chart: May 2026 OSR futures - 200 day moving average (grey line) and RSI (lower chart)

Soybean opinion

The ratio of soybean to corn prices in Chicago is closely watched at this time for year for evidence of which crop US farmers may prefer in the annual spring “battle for acres”.

Currently the ratio of new crop November-26 soybean futures to December-26 corn ones it, at 2.40, around neutral levels. This theme will come into closer later this week in the USDA’s Agricultural Outlook Forum, which will offer the first detailed USDA forecasts for US crops in 2026/27.

Soybean prices have extended their February rally, spurred by a post by US President Donald Trump that China is considering more purchases of US soybeans.

May-26 futures are up 6.6% so far this month, confronting a resistance level at $11.50/Bu around which prices set a December peak.

Hopes for Chinese purchases have certainly attracted the attention of funds, which raised their net long by 86.7K contracts in the week to last Tuesday, the biggest net buying spree since May 2024.

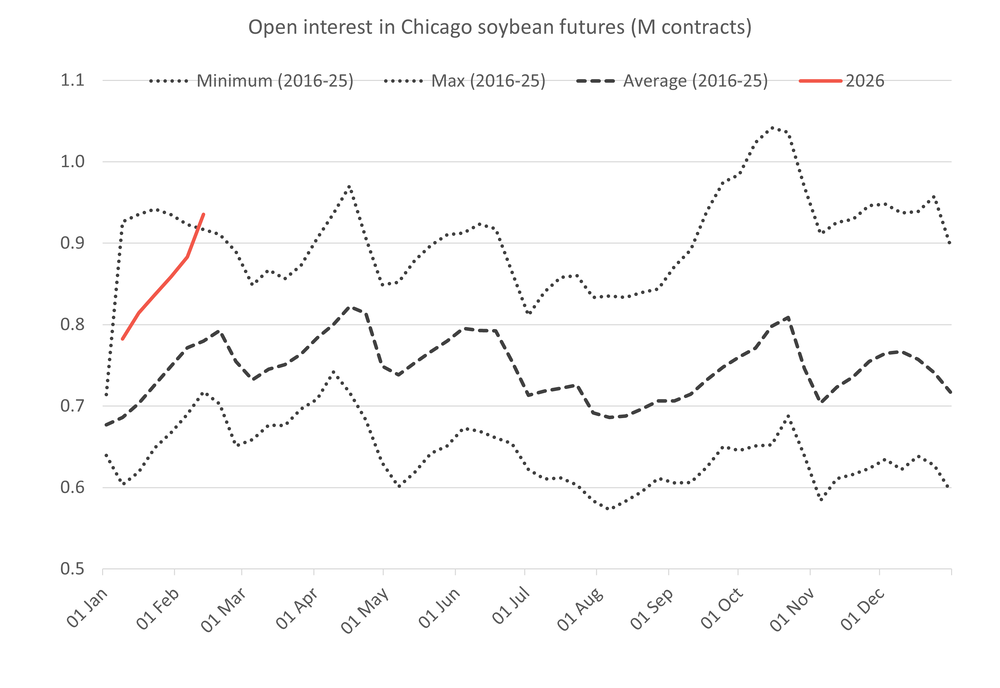

Fund buying has likely continued, to judge by the further buoyancy in prices later last week and an accompanying rise in open interest to above 950K contracts, well above levels usually expected at this time of year.

Not that the firm prices will do much to improve the US’s export case, and help it catch up on shipments slowed early in the season by a lack of Chinese custom, until the late-October deal between presidents Trump and Xi.

Indeed, US soybean export sales have slowed through the last four reporting weeks from 2.4Mt, the most since November 2024, to a 2025/26 low of 281.8Kt.

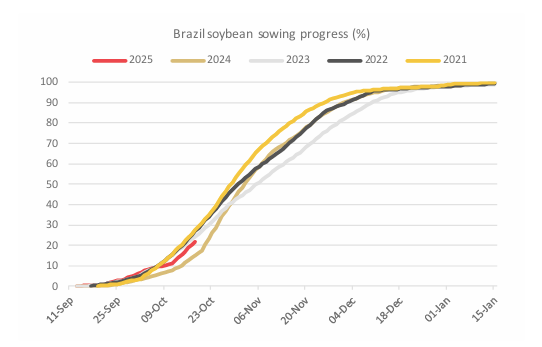

Instead, import demand is switching to Brazil, harvesting a crop for which estimates continue to edge higher. The USDA’s latest 180.0Mt figure, in last week’s Wasde crop report, is pretty much the market consensus.

This large crop is reaching port quicker than had been expected, backed by an unusually fast harvest pace in states such as top producer Mato Grosso. Merchants’ industry group Anec has raised its forecast for Brazil’s soybean exports this month to 11.7Mt, from 11.4Mt last week, representing an even higher February record. (The existing February high was set in 2025, at 9.7Mt.)

Competitive pricing is spurring Brazil’s exports too. Offers in the port of Paranagua are, at $424/t, some $40/t cheaper than US Gul prices.

Indeed, Brazilian competition should offer resistance to further gains in soybean prices, absent another geopolitical surprise.