Erith safety shutdown spurs UK rapemeal rally

A safety shutdown at the UK’s largest oilseed crushing plant is causing meal market shockwaves.

ADM has confirmed to CRM Agri that crushing operations at its Erith site in south east London “have been temporarily suspended following an intervention by the Health and Safety Executive”.

“Refinery operations at the site continue as normal,” ADM added.

The crush closure has prompted merchants to take ditch rapemeal offers for short-term delivery, up to April, while accelerating a rise in prices for later in the spring.

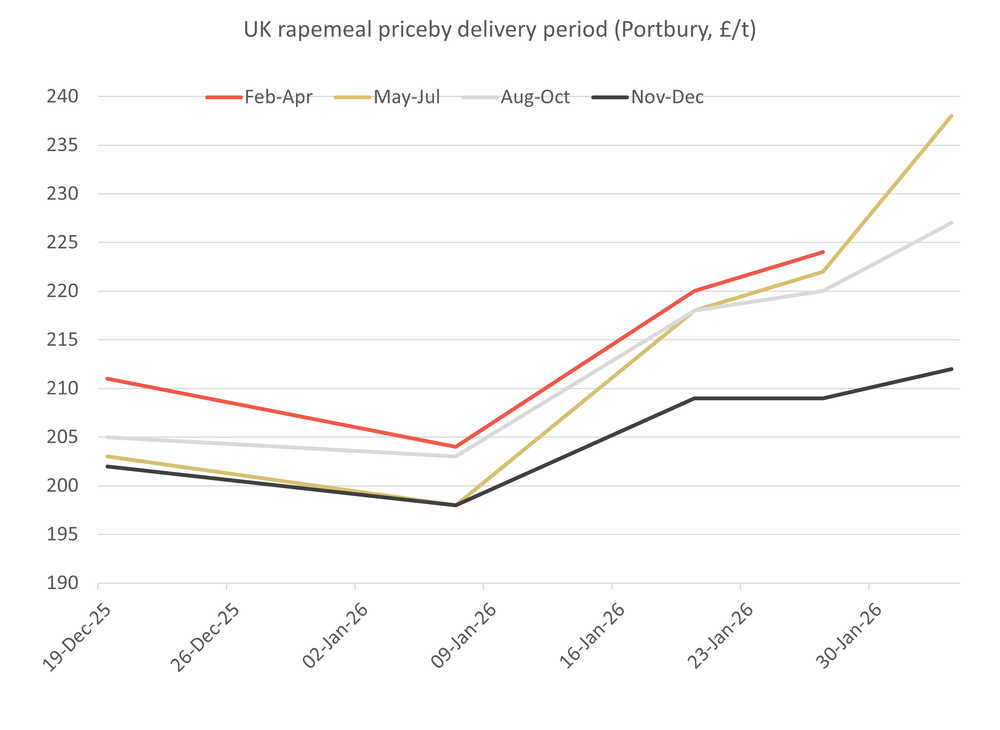

Rapemeal for May-July is offered at £238/t, basis Portbury, CRM Agri data show.

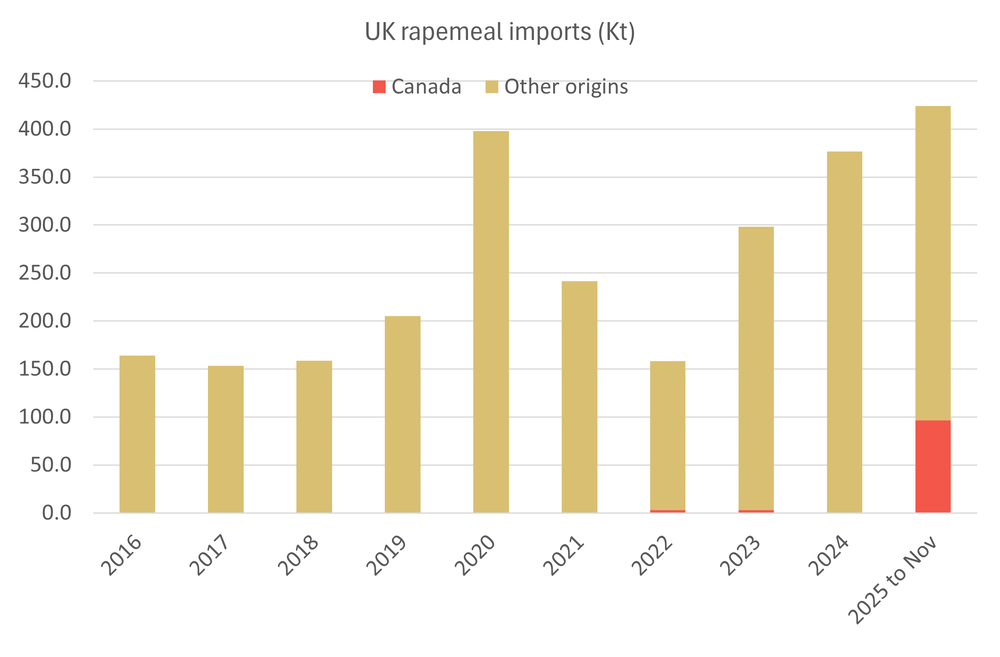

The rapemeal market was already on the rise, buoyed by factors including Beijing’s agreement to ditch a punitive tariff on Canadian canola meal, of which China has historically been a key buyer. Canada in the meantime diverted canola meal to Europe, including the UK, which took 96.5Kt for 2025 up to November, an unusually large volume.

The price of rapemeal for late spring delivery is now up 20% over the last four weeks, compared with a 3% fall to about £295/t in prices of any-origin Hipro soymeal. The relatively narrow discount of rapemeal to soymeal, of less than £60/t, looks unsustainable even if Erith were to stay offline.

The price of rapeseed itself has risen by some 2.5% over the same period to £430-432/t delivered, and is seen as shielded somewhat from Erith’s crushing shutdown by the UK’s reliance largely on imports, which should be the primary target for any demand loss.

The UK was a net importer of 440.8Kt of rapeseed in the first five months of 2025/26, the second highest total on data going back to 2012/13.

ADM added that it “has been co-operating fully with the HSE, has complied with all current requirements, and has undertaken the reviews requested.

“The safety of our employees, contractors, customers, and the wider community is our highest priority, and we remain committed to operating to the highest... applicable health and safety standards.

“Our focus is on resolving this situation as quickly as possible.”