Wheat prices slide, weighed by Russia crop upgrades

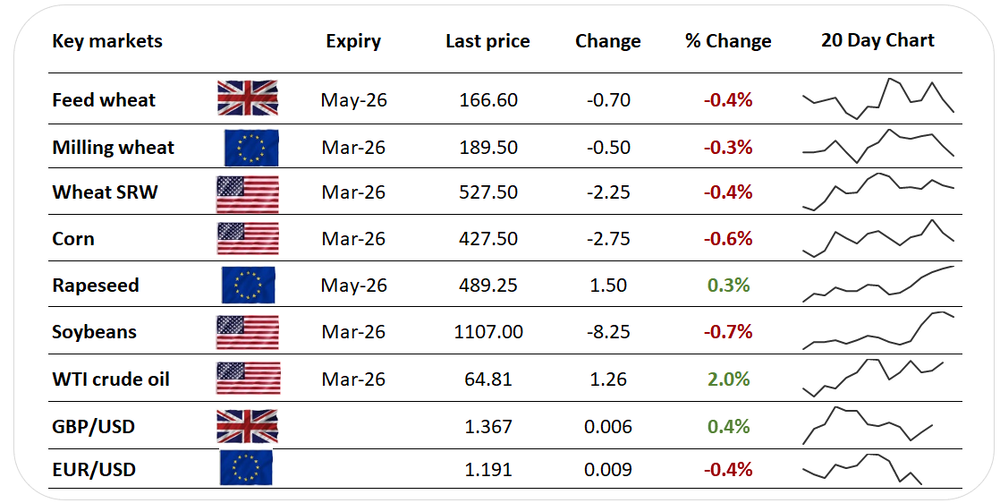

• Dollar-denominated commodities weighed by firmer greenback

• Russia crop upgrades by Ikar, SovEcon add to pressure on wheat prices

• Rapeseed sinks on margin squeeze, EU export uptick

Wheat prices headed lower, weighed by waning concerns for Russia’s 2026 harvest prospects, and joining a commodities retreat spurred by recovery in the dollar.

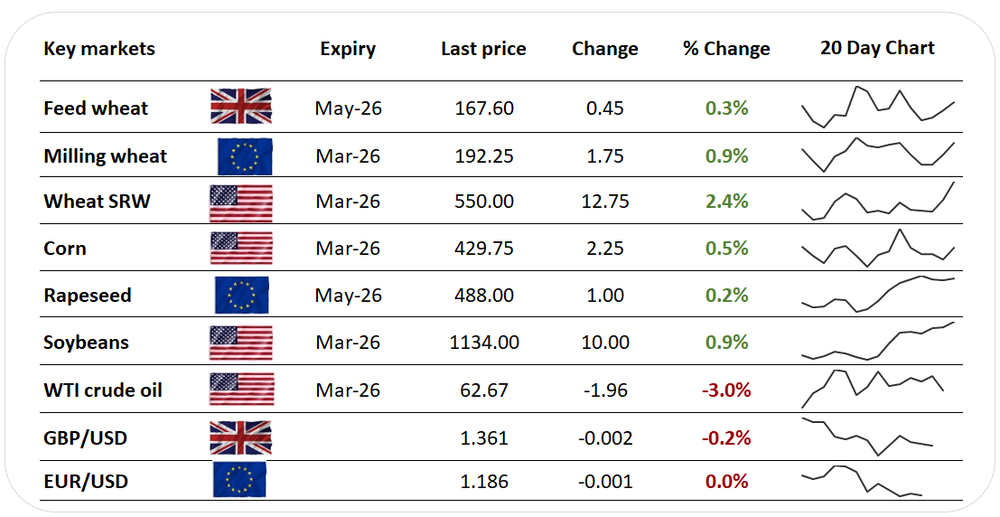

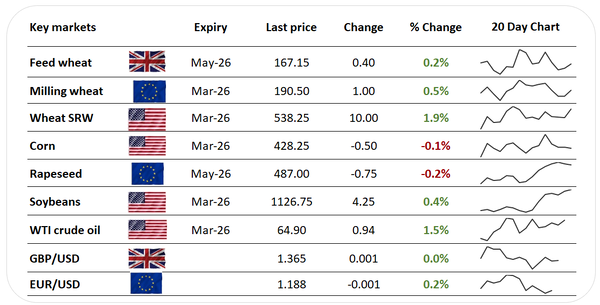

The Bcom index shed 1.6%, falling to a two-month low, as prices of a range of raw materials declined, weighed by 0.4% headway in the greenback against a basket of currencies, making dollar-denominated assets such as key commodities less affordable.

Gold fell 2.8% and silver by 6.2%, while in energy markets Brent crude shed 2.2%, weighed too by improving hopes for US-Iran nuclear talks. Iran’s foreign minister said the countries had reached an understanding on the main “guiding principles” of their negotiations.

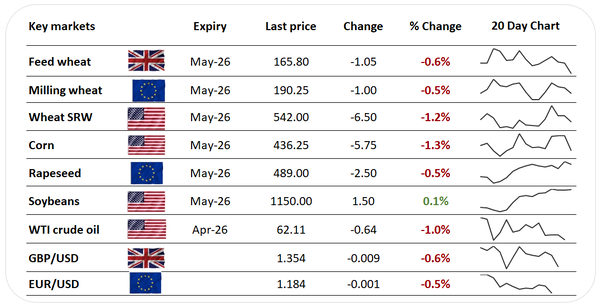

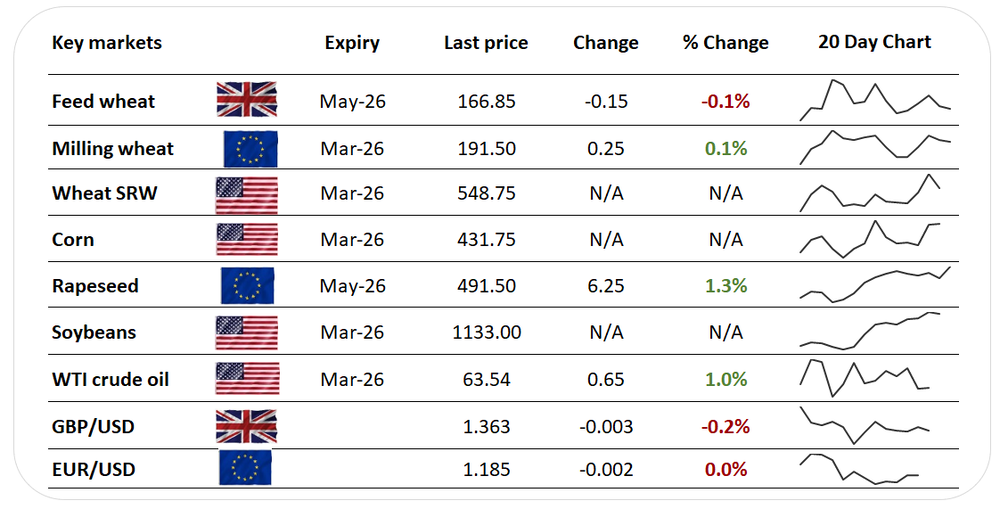

Among grains, soft red winter wheat futures for May-26 fell by 1.2% in Chicago, before finding support at their 100-day moving average and the $5.40/Bu mark.

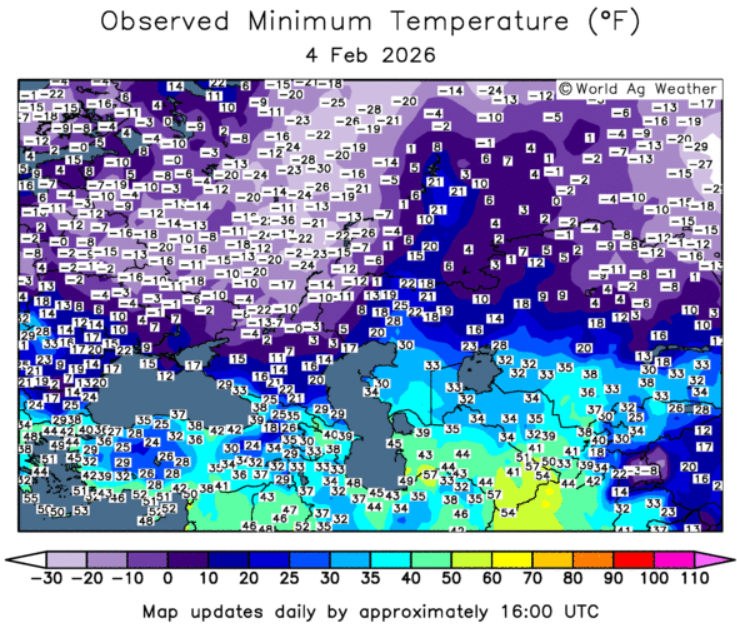

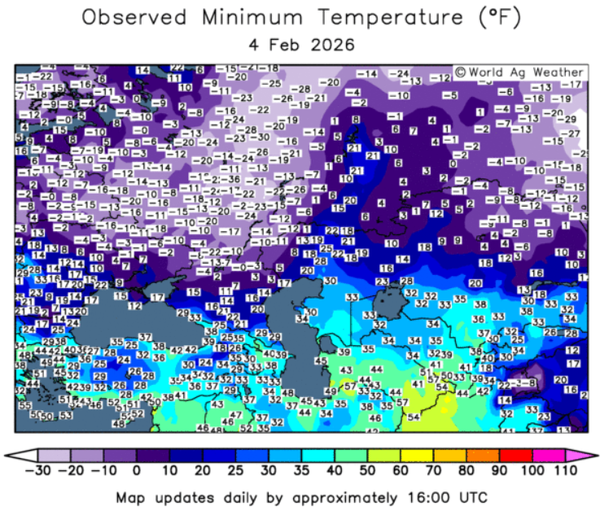

The contract was also weighed by upgrades to private analysts’ forecasts for Russia’s 2026 wheat harvest, underlining that recent cold snaps were perceived as having wrought little damage. SovEcon lifted its forecast by 2.1Mt to 85.9Mt, following on from Friday’s upgrade by Ikar of 3.0Mt to 91.0Mt.

US wheat export data for last week, at 375.4Kt, shrank from the 580.6Kt the previous week.

European wheat prices fell too, although market pressure was moderated somewhat by softness in the euro and sterling against the dollar.

Paris milling wheat for May-26 traded down 0.5% in late deals, while London feed wheat for May-26 shed 0.8%.

Rapeseed for May-26 also reversed in late trading in Paris, having spent most of the session in positive territory.

The contract shed 0.5%, falling back below the key €490/t mark, weighed by crude oil markets, as well as some dynamics closer to home.

Rapeseed’s 2026 rally, in far outpacing gains in rapeseed oil prices, has squeezed crush margins.

Furthermore, supplies from Australia are fuelling signs of recovery in EU rapeseed imports. The EU Commission upgraded by 136Kt to 201Kt its estimate for the bloc’s rapeseed imports in the first week of February, lifting it to the biggest weekly figure of 2025/26.