Will rising US wheat prices lift European values - bean market outlook

Prices

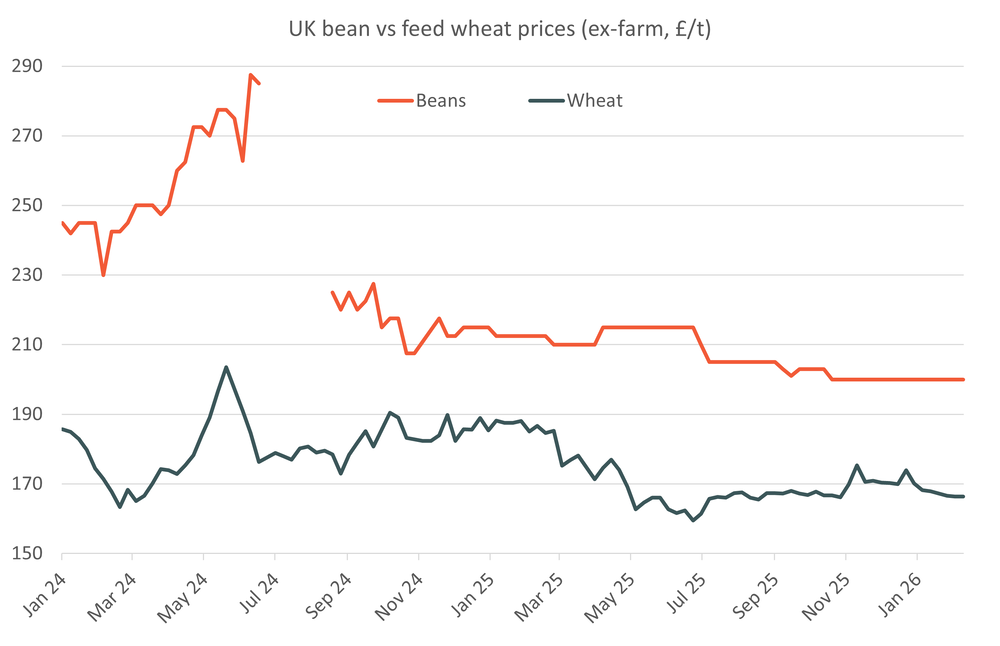

*On the currency markets, sterling eased against a reviving dollar over the week to Monday’s close, but remained up 1.4% for 2026 so far. The pound softened further in early deals in Tuesday, after weak UK employment data was viewed as boosting the chances of a cut to UK interest rates next month.

*The average UK milling premium shrank further, to an unusually narrow £3.20/t April-26 basis. One pressure on the premium came from UK trade data for December which showed wheat imports recovering to 241.5Kt, from the two-year low of 168.9Kt recorded for November. The gain was spurred by a bounce to 83.0Kt in imports from Canada, an origin for high-spec wheat, from the November figure of 12.3Kt.

*Rapeseed prices extended their run of unbroken weekly gains for 2026, to hit £444/t March and £410 Harvest, as delivered to Erith, an eight-month high. Headway remains supported by a modest pace of EU imports, and geopolitical factors such as China’s return to buying Canadian canola.

UK wheat prices underperform US ones

Will UK wheat prices follow US prices higher?

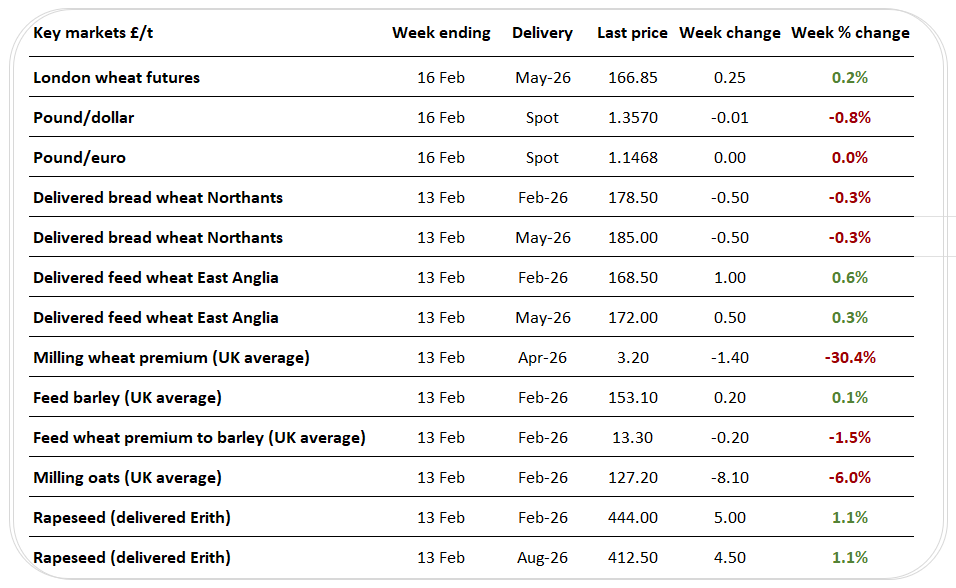

Wheat prices have diverged across the Atlantic, and even the Channel, so far this year. While London May-26 futures have sunk by 2.0%, Chicago ones have risen by nearly 6%, while Paris peers have marked time.

Only part of that disparity is explained by currency moves. In dollar terms, London prices have fallen 0.5%.

Nor does singling out the UK’s cash market, which has proved resilient to the fall in London futures, eliminate the performance gap. Delivered feed wheat prices, basis East Anglia, are still no better than unchanged this year in dollar terms.

Viewed from this perspective, the UK market should be due its own recovery, shouldn’t it?

Unfortunately for growers, Chicago’s recent outperformance is more a case of it playing catch-up than leading from the front.

Analysis of long-term prices (chart above) shows that Chicago futures - weighed by dollar weakness and concerns of trade risk pose by the Trump agenda - fell to unusually large discounts to UK, and Paris, peers last year.

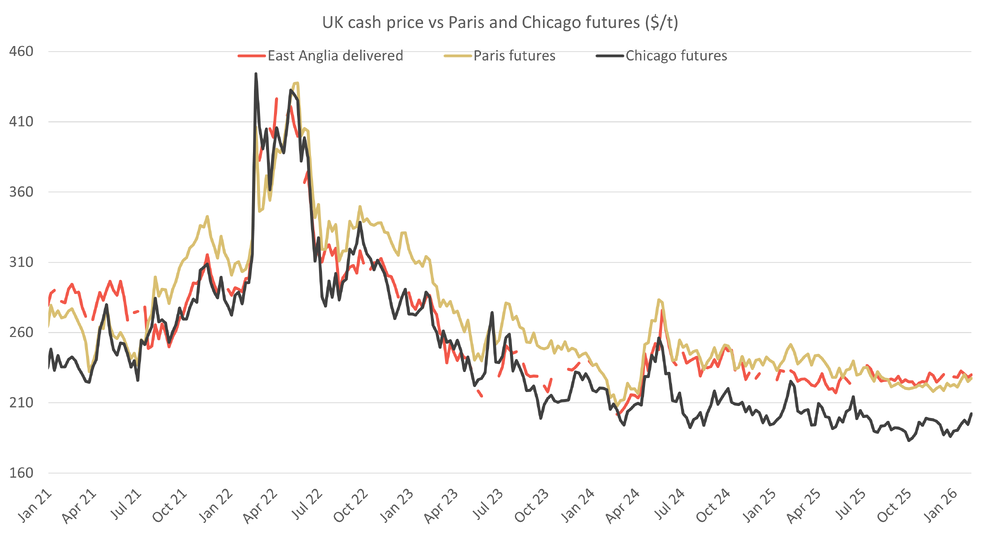

This year, these gaps have started to narrow again, a trend easier to see in this shorter-term chart.

Even then, the current East Anglia premium of about $28/t to Chicago futures is more than twice the five-year average of £13/t or so.

This suggests still US values may have further slack to make up before UK prices find themselves lifted by the tide. Recovery in US prices does not, yet, look sufficiently substantial to bolster European markets.

Bean market outlook

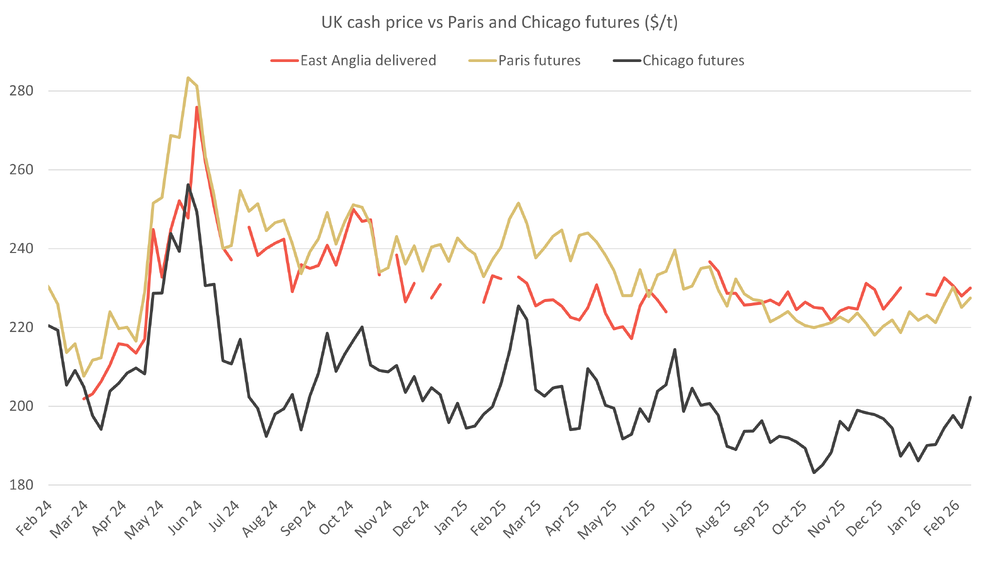

Field bean prices are holding unusually steady, even by the standards for what is a somewhat illiquid market.

Values have held steady at around £200-205/t since harvest, a flatter market than even that of UK cash wheat, against which bean prices have rebuilt a premium of about £35/t.

The flat market disguises nonetheless underlying market tension.

Key bean consumption signals are sluggish. UK bean exports, at 30.1Kt in July-to-December, ie the first half of 2025/26, have made an unusually slow start to the season. The 10-year average for the period is 89.2Kt.

Domestic demand for feed rations has been relatively modest as well. The 45.5Kt used by feed mills in the July-to-December period was, while up 5.5Kt year on year, behind the 10-year average of 64.0Kt.

However, supply levels have been constrained by a modest 2025 harvest, pegged by the trade at about 450Kt, below a 10-year average of about 600Kt.

Beans have lost ground to the SFI environmental scheme, besides losing yield last year to prolonged dryness.

Some recent events have tipped in favour of price support. The closure of Vivergo, which produced distillers’ grains (DDGs) as well as ethanol, has created opportunity for other protein feed ingredients.

The ongoing shutdown of the Erith crush plant has squeezed rapeseed meal supplies too.

Moreover, there have been some early setbacks to 2026 UK bean output too.

Not only did the AHDB estimate all-pulse area down by 12% year on year, at 178Kha, but there have been “increasing early reports of severe chocolate spot in winter beans”, the PGRO industry group says.

“Foliage has remained wet with no extended drying periods, and hence disease has had good conditions for development.”

Wet weather which has encouraged the spread of the fungal disease is hampering fungicide application too.

The success of the spring planting season may prove key in determining whether beans can maintain prices which look rich by comparison with eg wheat and meal. Beans, most of which are seeded in the spring, do offer an alternative for farmers faced with depressed malting barley premiums, or washed out winter crop area, but weather as well as disease fears will play a role in decision making.

Weather

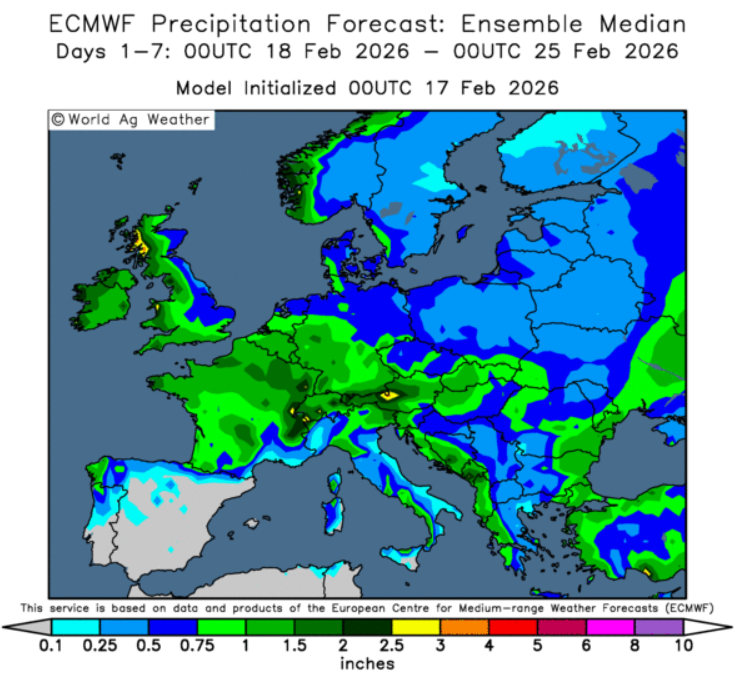

The weather outlook has trended wetter for the rest of February, but conditions should be drier nonetheless than those the UK has been used to for most of 2026.

This is especially so for eastern parts of England and Scotland, which should see only scattered showers over the next week (chart above).

The pattern of the last week of February looks similar, before the start of March sees start of a more settled spell through the UK, bringing rainfall levels around the average. Temperatures will stay close to normal through the next fortnight.

March will, after its relatively dry start, end on wet note, current weather maps show. In like a lamb and out like a lion perhaps.

The conditions suggest improving opportunities for fieldwork and spring plantings, particularly on lighter land in eastern areas.

UK data