What’s behind surging canola and rapeseed prices?

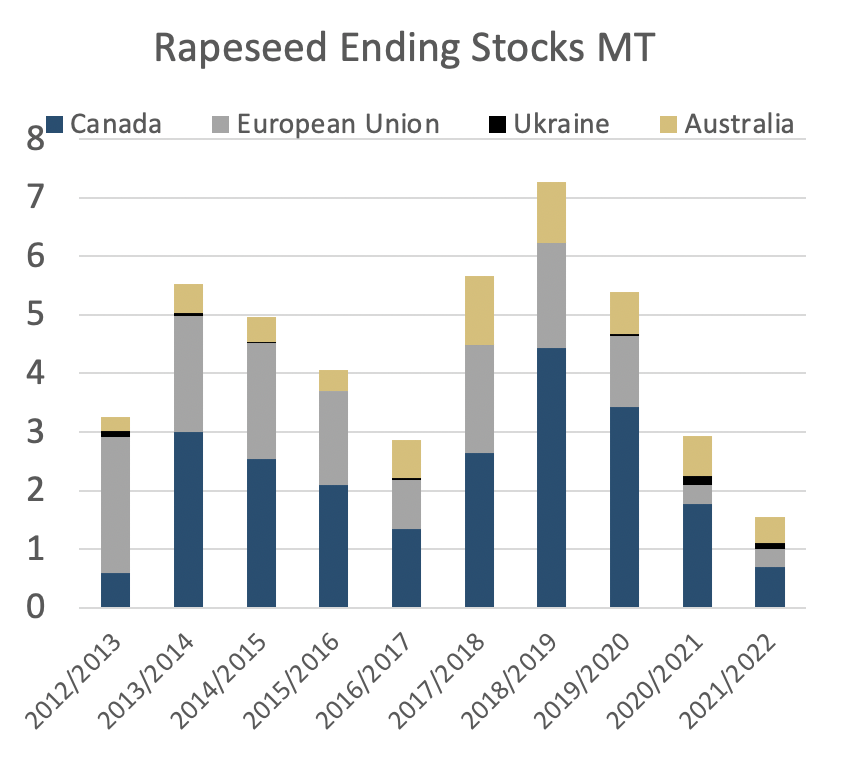

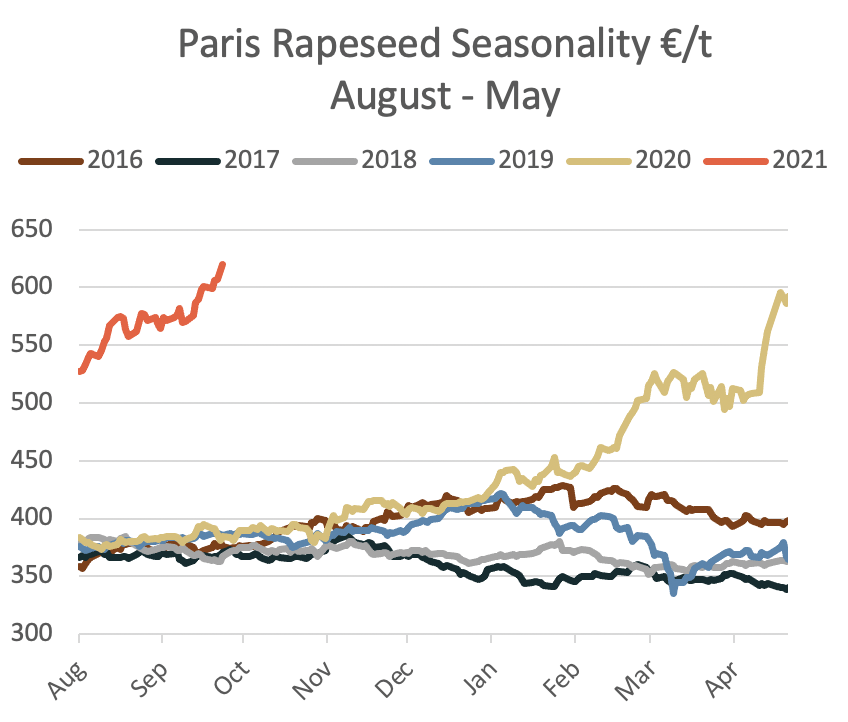

Surging canola prices, or rapeseed as it’s known in Europe, have been long overdue following four consecutive years of stock depletion amongst key producing and exporting regions, most notably Canada where canola stocks have fallen from 4.4MT in 2018/19 to a forecast 691KT by the end of 2021/22. However, this retreat has not been the only catalyst of what seems like a relentless bull run for European benchmark rapeseed futures – which have now rallied to over €600/T, having begun 2021 at €396/T – of which a large part has been played by the wider oilseeds complex.

European farmers have been reluctant growers of rapeseed in recent seasons with a ban on Neonicotinoids and Flea Beetle damage making it a risky crop for many. However, with spot prices now over €600/T, our expectation is that plantings could increase by up to 20 per cent on last season as the odds look more favourable for the grower with current prices as they are.

Vegetable oils

Labour shortages and weather issues in key palm producing regions of Malaysia and Indonesia have caused a surge in palm oil prices, with demand fuelled by a global economic recovery, further driving the oilseeds rally and underpinning values at levels well above average, a significant bullish factor especially for high oil content seeds such as canola.

On top of this we have seen a sharp depletion in soybean stocks, a competing source of feedstock for biodiesel, which explains why a great proportion of the crush margin is currently oil. These lower stocks are down to an extended US export programme and lower production following North and South American droughts, causing soybean prices to surge by over $5/bushel to nearly $15/bushel at its peak in June.

With a greater oil proportion in rapeseed than in soybeans, this bullish global vegetable oil market is being felt to a far greater extent than in the larger soybean market.

Prices are in danger of looking over valued, as we enter key producing months for palm and what looks set to be a strong Australian canola export season, however it is unlikely we will see a return to more normal pricing levels until there is much more confidence in improved supplies throughout the oilseeds complex and an easing of global vegetable oil markets.

Receive daily market updates to your inbox | Find out more about our services | Read more articles