USDA surprises market once more – September Stocks Report

The USDA shocked the market at the very end of September, releasing stock estimates far below market expectations. Surveying 62.5K producers for on farm stocks and commercial operations, the USDA 1st of September stocks for corn, soy and wheat were expected by analysts to be far larger than the survey found.

Just as US corn, soy and wheat markets had begun to turn bearish as export sale purchases made by China started to slow, the reduction in on paper stocks has removed a further amount of available supply for 2020/21.

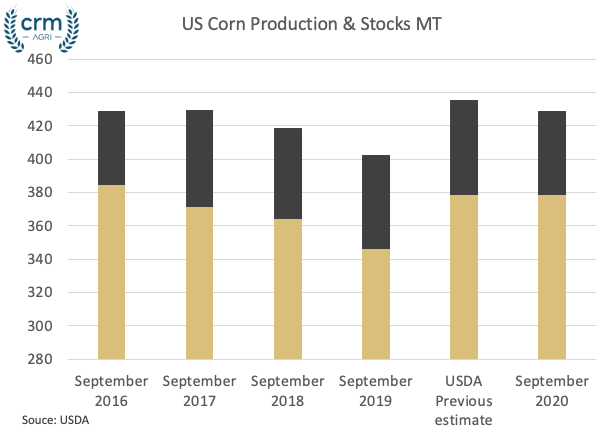

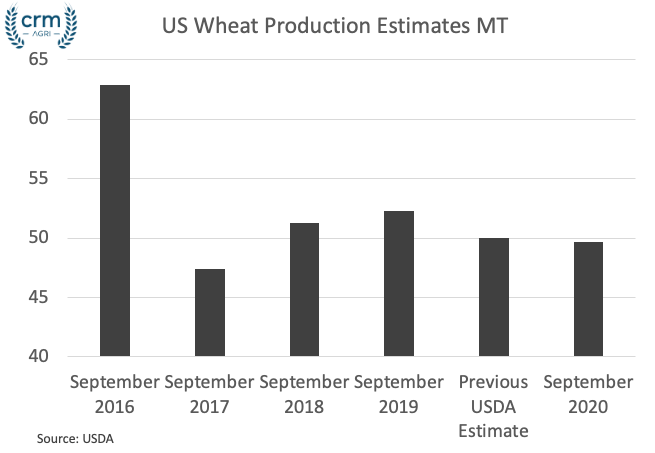

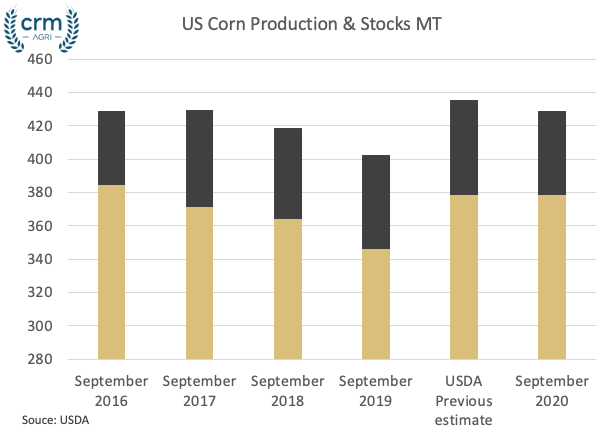

While there have been reductions to soy and wheat, the changes to corn stocks have led the momentum for grains.

1st September corn stocks were estimated at 1.995 Billion bushels (50.68MT) far below the trade estimates in the region of 2.25 Billion bushels (57.15MT). With close to 6.5MT less stocks than expected, combined with the fast export pace and US corn stocks are substantially tighter than markets previously thought.

Why so shocking?

However, as part of the 1st September stock reduction shock, revisions to June stocks were also made, creating confusion and leaving three additional possibilities: Either the US production estimates are incorrect, usage data is incorrect and is higher than thought, or the stocks data is incorrect, or indeed all three.

With more data and confidence in the US area, yields and the weight of the corn crop could be to blame. On the demand side, there is also confusion, with close to 15-year record US animal feed demand being stated and somewhat unexplainable. Additionally, combined with the US ethanol demand destruction, it is unclear as to where the stock disappearance has been accounted for.

While there are doubts as to the validity of the US data, the reduction in stocks, combined with the storm associated crop loss, and fast paced purchases made by China has certainly changed the grain landscape in the US. Moving from one of large surplus and stock carry over into 2021/22 to a more modest ‘average’ surplus, the direction of corn markets is now increasingly reliant upon Brazil, with the competing factors of area increase and increased dry weather La Nina chances.

Following the confusion made in the UK by the Defra/AHDB balance sheet recently, it is a reminder that scepticism is needed for all ‘official’ data, whilst remaining respectful of the fact that this data has an influence on market sentiment, particularly in the short term.

For further information, please contact Peter Collier – pcollier@crmagri.co.uk