USDA November WASDE Overview

USDA WASDE Overview

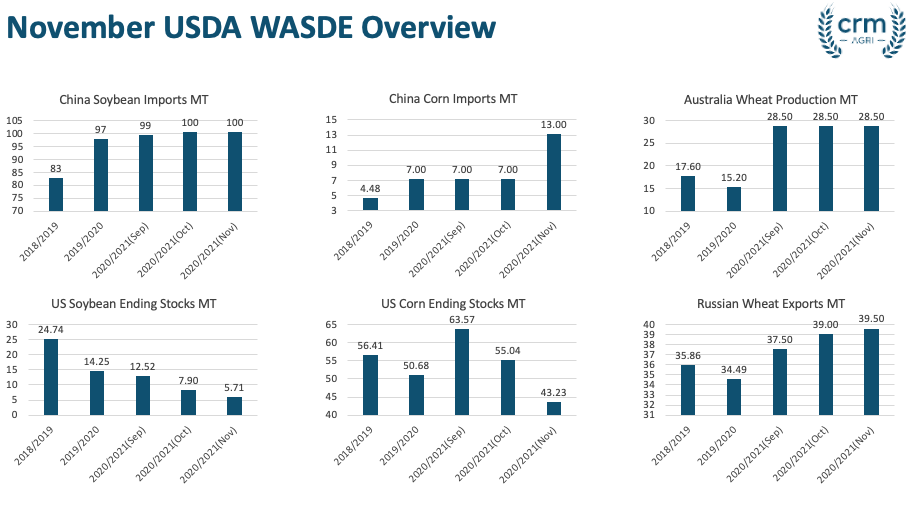

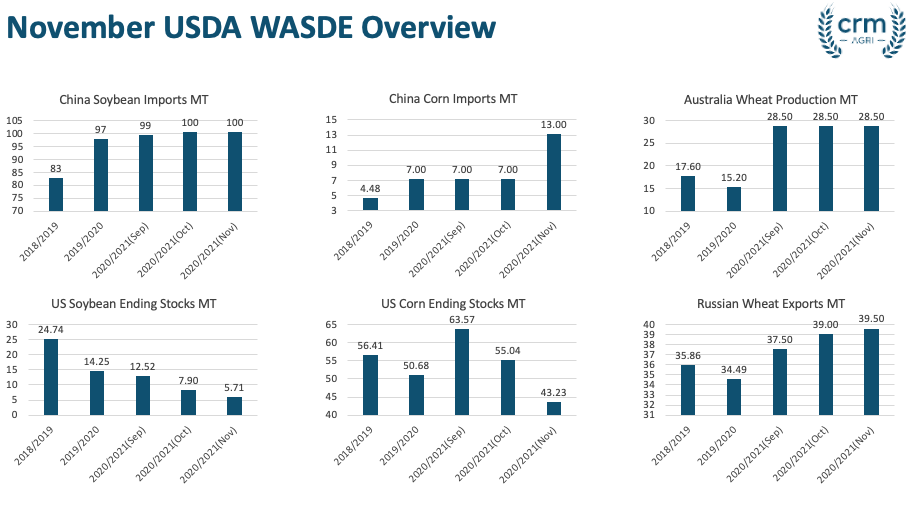

The November USDA WASDE provided support to both grain and oilseed markets.

Corn

While the majority of the November WASDE changes were expected, there were some key surprises, leading to a rally in US corn futures.

Ukraine – Following the unfavourable conditions for maize, private estimate for maize production have been close to 29MT for quite some time due to poor yields and tight export markets. The downgrade by the USDA to Ukraine maize production to 28.5MT was therefore of little surprise for those involved, but with such a large volume of speculative fund driven involvement in corn markets added support to global prices.

China – Having driven a large proportion of the rally in global corn prices, there were large expectations that the USDA would seek to increase the estimates for Chinese corn imports. Having previously been capped at 7MT, inline with Chinese tariffs, the speed and size of export sales of US corn to China has surpassed this. However, at 13MT, there are now two possibilities, either the USDA is underestimating the full season import demand, or that China has already sourced nearly all their required imports. At over 10.7MT of US corn sales to China having been made already for the 2020/21 season, should the USDA be correct in the 13MT total season import requirement then China will soon be stepping back from the export market.

US – Taking markets by surprise and leading to the rally in corn markets were downward revisions to US production estimates. While the harvest of US corn has been ahead of average, without large scale reports of worse than expected yields, the downward revision by the USDA certainly came as a shock to the market. Decreasing production estimates by over 5MT to 368.49MT.

While production estimates were lowered, estimates for full season exports were also increased. At 67.32MT, production estimates were increased by over 8MT, predominantly due to increased sales to China.

Following the surprise downgrades to the US crop size estimates, and the increases to export forecasts and US corn ending stocks were downgraded by almost 12MT to 43.23MT.

Wheat

The November USDA WASDE provided little fresh news for global wheat markets. Minimal changes were made overall, consisting mainly of an increase to Russian exports, and cuts to Argentina. Cutting the wheat production figure for Argentina to 18MT was largely expected by markets, and still remains slightly optimistic relative to private estimates for a crop closer to 17MT. Export estimates for Russia increasing slightly are again fairly academic, and with the strong early season demand, in line with expectations. The one notable absence from any changes being made was the leaving of Australian production, with continued good conditions for Australian production, private estimates are now close to, if not higher than 30MT, which would offset the cuts made to Argentina.

Soybeans

Oilseed markets, like with corn, received support from cuts to forecast US ending stocks.

US – large cuts to US production estimates were not expected in the November WASDE, so cutting the US production estimate to 113.5MT, down from 116.15MT in October provided immediate support to oilseed markets. With the cut to production, while the remainder of US usage and export estimates remained virtually unchanged, ending stocks have taken a further hit, down to just 5.17MT.

China – Responsible for the majority of global soybean imports, estimates for Chinese imports were maintained at 100MT. However, ending stocks are estimated to increase to 26.8MT, equalling the record stocks of 2019/20. With record stocks now projected, there is the possibility for reduced overall seasonal import requirement, especially given the price increase and global soybean tightness forecast prior to the Brazilian harvest.

South America – Looking to Brazil and Argentina, there will be an increased focus this season on soybean production in these two counties as La Nina conditions are in focus. The November WASDE maintained production estimates for Brazil at 133MT, a record, while estimates for Argentina were deceased by 2.5M to 51.3MT, while there were not significant estimate changes this time round, this Brazilian estimate will be in focus in subsequent supply and demand estimates.