USDA February WASDE Overview

Uninspiring WASDE Has Bulls Wanting More

Wheat

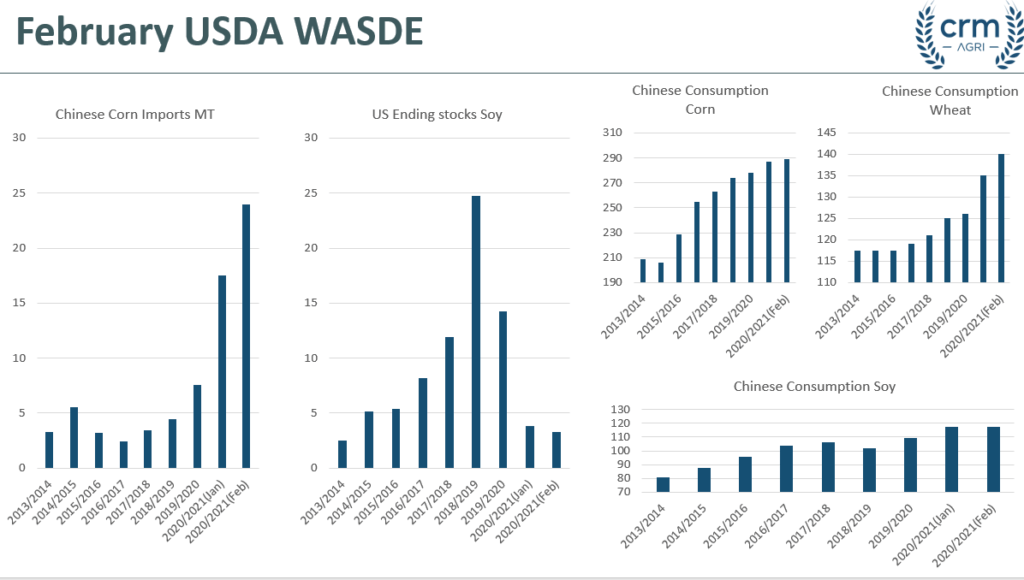

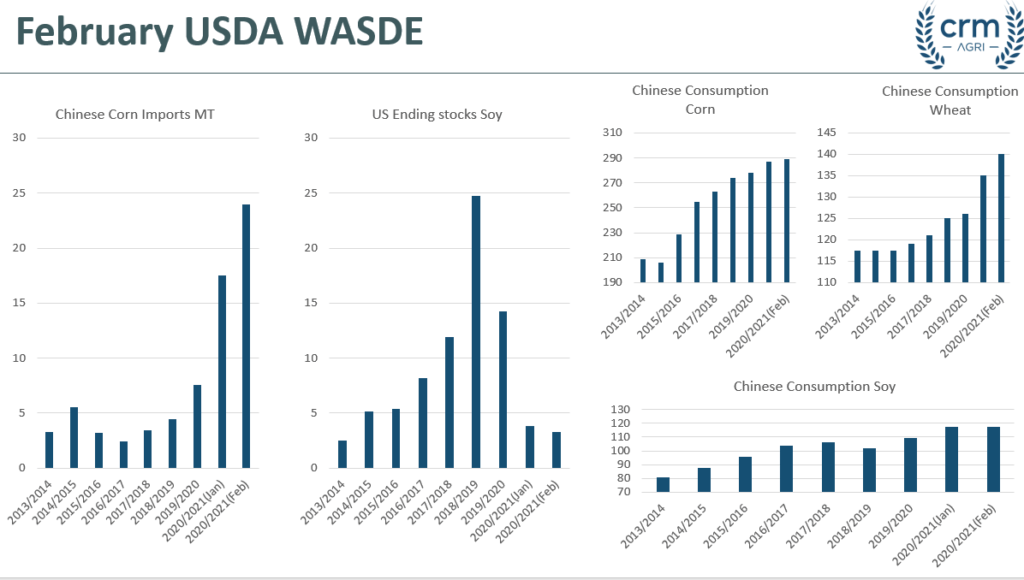

The USDA WASDE contained little in the way of surprises for the world wheat supply and demand. Globally, world wheat stocks are forecast to decline as Chinese feed demand swells, production estimates for Argentina were downgraded marginally from 17.5MT to 17.2MT and EU stocks were trimmed. However, overall, this was a fairly neutral to bearish USDA WASDE, given Russian export estimates were maintained and there was little in the way of shocks.

Corn

Overall, the USDA WASDE proved to be slightly bearish. While there were notable increases to Chinese import estimates, now standing at 24MT, up from the largely disbelieved 17.5MT and US ending stocks were reduced. However, Chinese import demand has been well known to be near 24MT for some time, and pre-report polls expected US ending stocks to be even tighter.

Looking to South America, and production estimates for Argentina and Brazil were maintained at 47.5MT and 109MT respectively, which given the La Nina concerns has been viewed as bearish for corn markets.

Soybeans

From a soybean perspective, there were similar factors as with corn markets. US ending stocks were revised downwards yet again to a very tight 3.25MT, down from a previously tight 3.8MT, but again this was largely expected. Giving an overall bearish tone to today’s WASDE was again maintaining production estimates for Argentina and Brazil, maintained at 48MT and 133MT respectively.

Read the full February USDA WASDE here