USDA December WASDE Overview

Our view of the USDA December WASDE

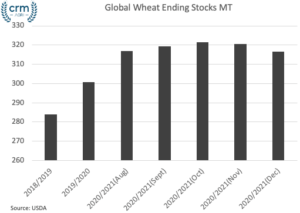

Wheat

In terms of wheat, the December USDA WASDE has been largely overshadowed by the possibilities of an export tax being placed on Russian wheat later this season. The changes in the December WASDE were largely expected with Australian production increased to 30MT (although still below the ABARES estimate, so expect further upward revisions in January). Canadian production was also increased marginally to 35.18MT, reflecting StatsCan, and Russian production was raised to 84MT, with total season exports increased to 40MT. Overall, a rather uninspiring final WASDE of 2020 and arguably a slightly bearish tone to finish the year.

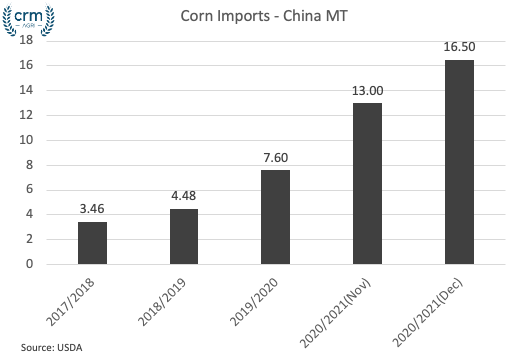

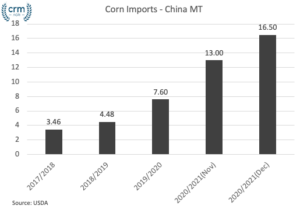

Corn

In the December WASDE, US corn estimates were largely left unchanged and production for Argentina was reduced 1MT, but increased beginning stocks completely offset this. Brazilian production was left unchanged too, but Chinese import estimates were raised to 16MT. There is still a feeling that at 16MT there is further headroom for total season Chinese imports, but this is only likely to be seen later in the season should purchases of Brazilian corn be made. Again, a relatively calm WASDE, although arguably slightly supportive with potentials for downgrades for Brazilian production in January.

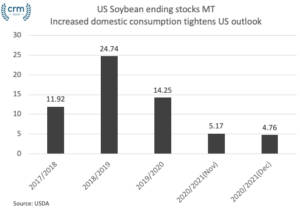

Soybeans

Due to increased estimates for domestic demand, the December WASDE decreased US soybean ending stocks once again, down to 4.76MT (408KT down month on month). The continued tightening of on paper US supply has the potential to maintain support for Chicago soybeans. The other changes in the USDA WASDE were minimal, with Chinese and Brazilian supply and demand figures virtually unchanged. Overall, a slightly supportive USDA WASDE, there is very little room now for any additional Chinese purchases of US soybeans. The oilseed market remains very tight into Q1 of 2021.