US ethanol production recovering

Daily Markets

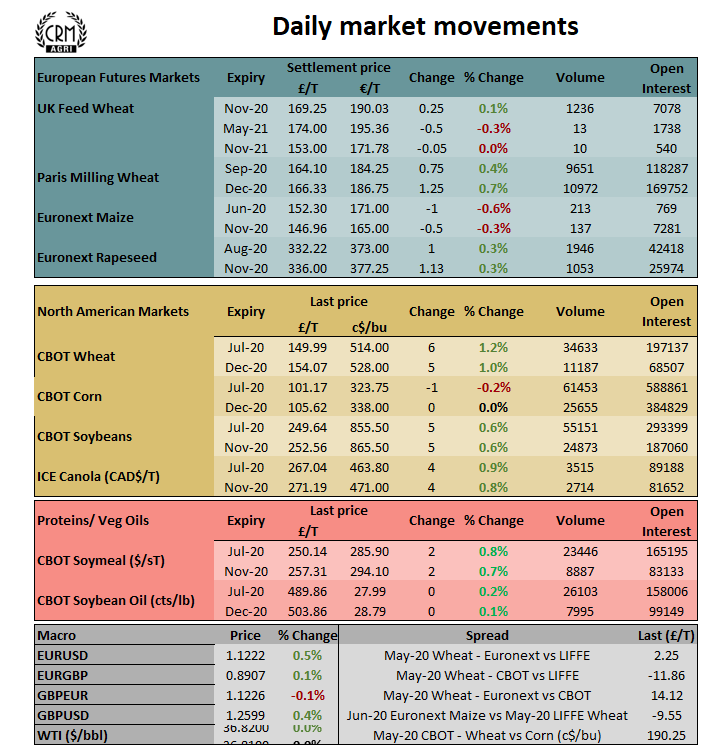

Rainfall in key Black Sea production areas which has eased some yield concerns. Crop plantings in the US are nearing completion, and emergence is also currently above average at 78%, far ahead of last year’s figure of 42%. The condition scores for the US corn crop have also increased with 74% in good to excellent condition, up 4% from last week.

The value of the Pound relative to the Euro has so far this week remained able to brush off a large proportion of the EU-UK trade negotiation pessimism, but as pressure has mounted the Pound fell back bellow £1=€1.12. Friday will prove significant with progress announcements expected to be made about the ongoing trade negotiations with significant issues remaining.

August Brent crude oil briefly touched $40 a barrel, seen as a milestone in recovery following global demand destruction as a meeting of OPEC+ has focused on continued cuts to global oil production. Oil volatility will continue to be driven by the scale and longevity of agreed cuts.

Following the uncertainty about US – China soybean exports, a further 120KT of soybean sales for 2020/21 to ‘unknown’ destinations have lent support for US soybean futures, with Nov-20 Chicago soybeans breaking out of the previous months range to reach c$865/Bushel.

The Brazilian real has surged 3% relative to the US dollar, the best gains in two years at $1=R$5.044, supporting global soy and corn markets. The weakening of the Brazilian currency had allowed increased competitiveness of Brazilian exports.

In a sign of increasing fuel demand, US ethanol production has recorded the 5th consecutive week of increasing production. Increasing to 765K barrels a day, up from 724K barrels a day the previous week. Production increases have occurred as stocks have been run down, removing some of the pressure on corn. However, as the pandemic continues to disrupt travel, and there remains protests and potential curfews in the US, demand remains subdued.