Rapeseed at fresh contract highs

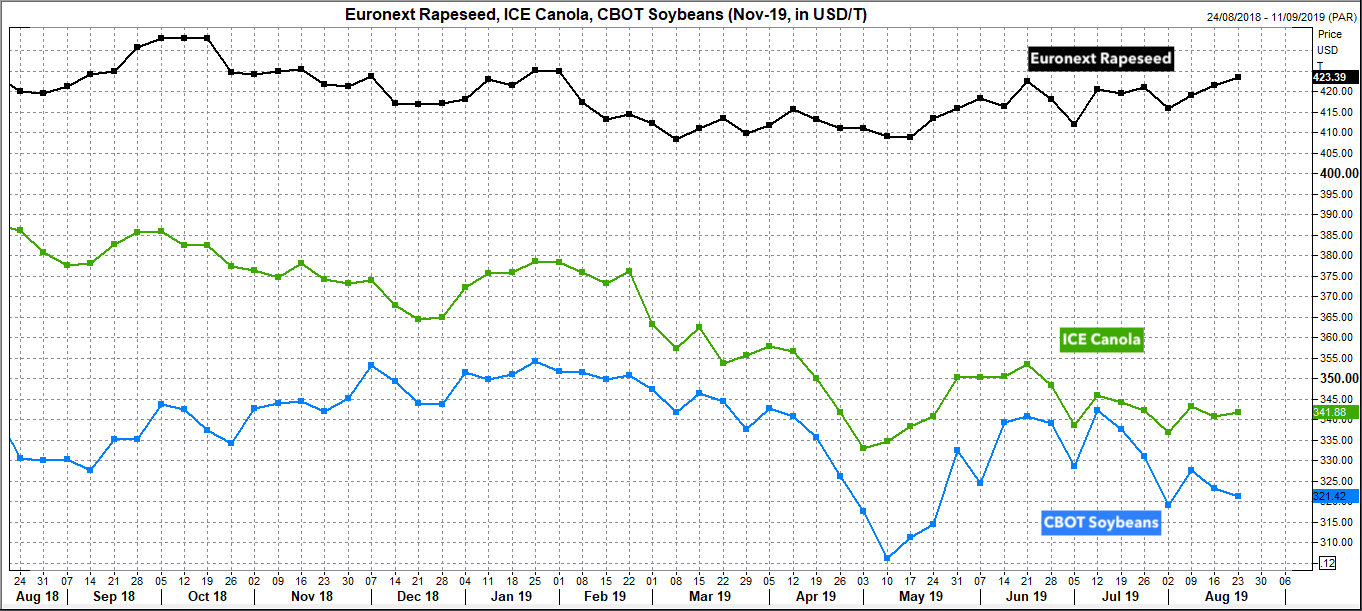

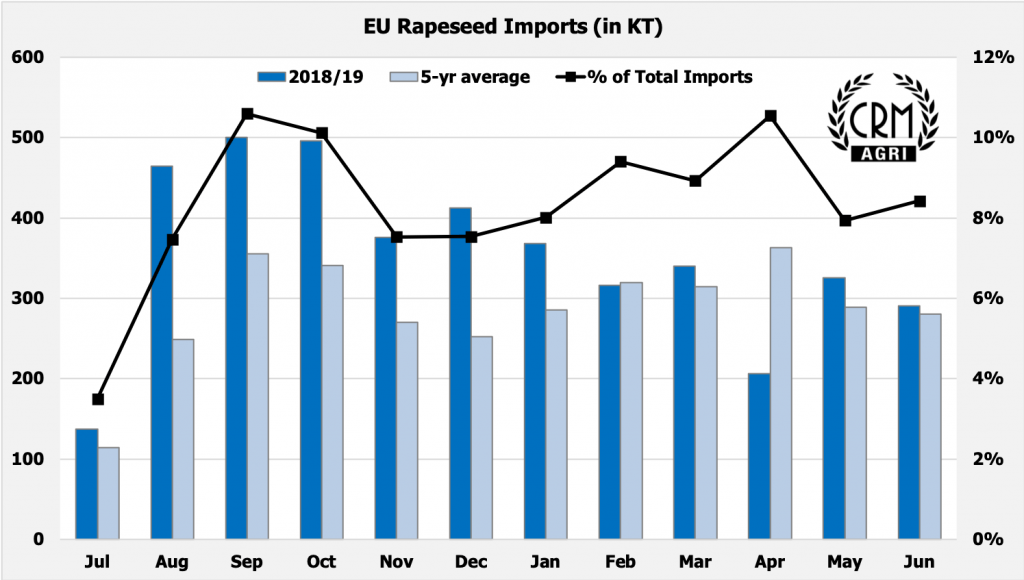

New week and new high for EU rapeseed futures prices amid a reduced 2019 EU crop which will require record imports of the oilseed this season and pushed rapeseed oil prices to its highest level in Rotterdam since November 2017. The latter also results from the recent EU decision to increase tariffs on Indonesian palm oil. As of Aug 11th, the European rapeseed imports were already 13% higher than a year ago at 227KT whilst the busiest months of the EU import season remain September and October, accounting for more than 20% of the annual total on a 5-year average.

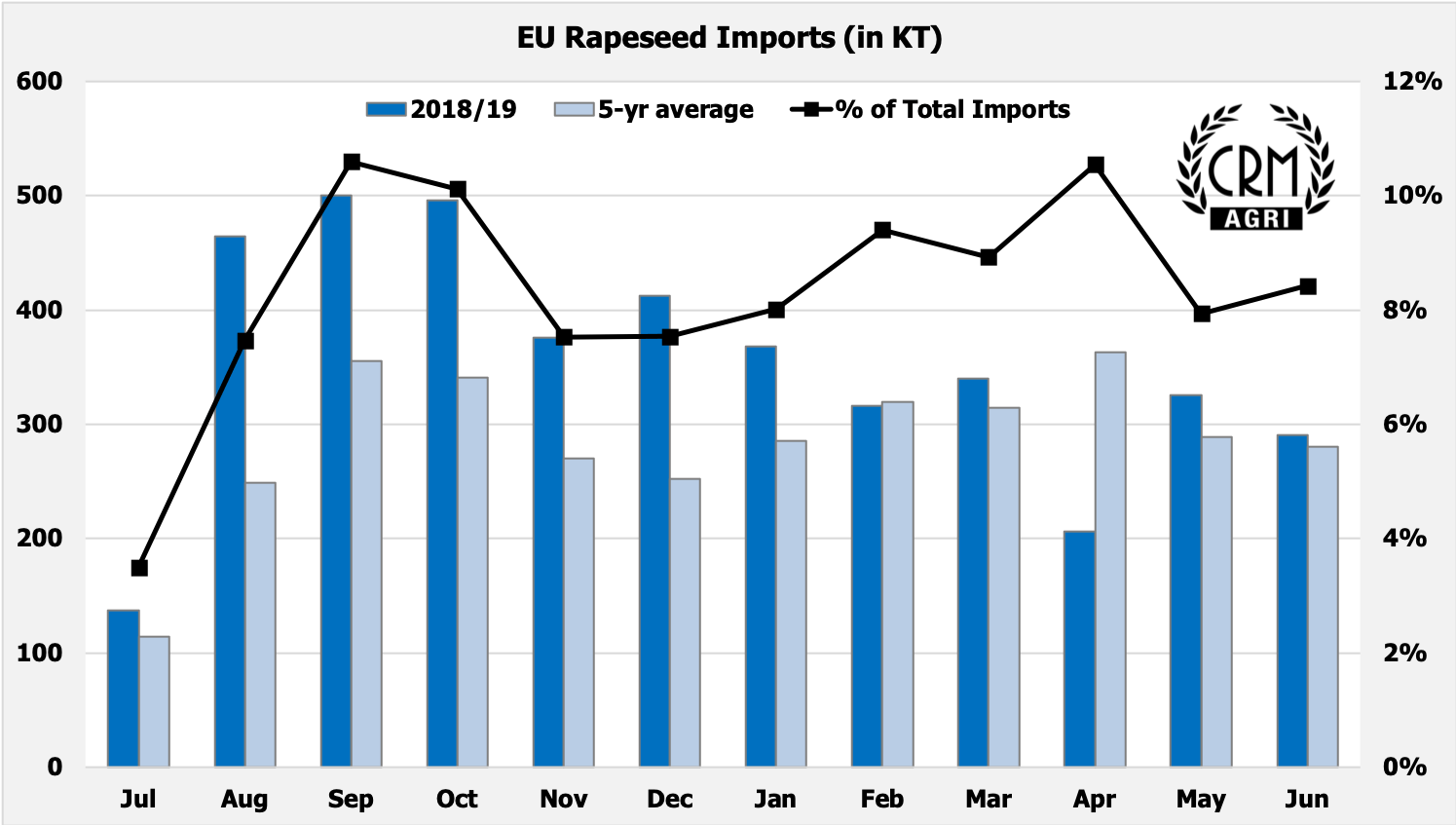

The low soybean pod counts and the delayed maturity of the US crops reported from the 2019 ProFarmer Midwest Crop Tour which kicked off at the beginning of the week were also underpinning oilseeds prices. Medium term though, the ongoing US-China trade tensions, the decimating African Swine Fever virus spreading in South East Asia curbing soy demand and the weakness in South American currencies (Argentine peso & Brazilian real) are difficult to ignore and will continue to cap any rally in price, particularly for soybean which currently trades at a $100/T discount to EU rapeseed.