October USDA WASDE Highlights

The October USDA WASDE is viewed as the first relatively accurate representation of northern hemisphere grain and oilseed supply, combined with growing confidence in the outlook for the southern hemisphere.

Wheat / Barley

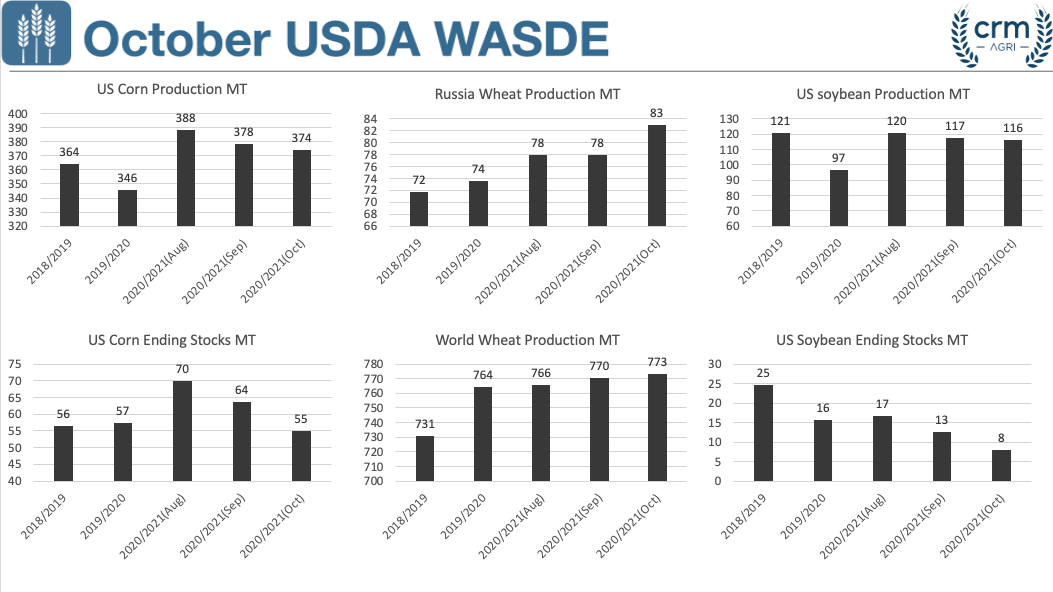

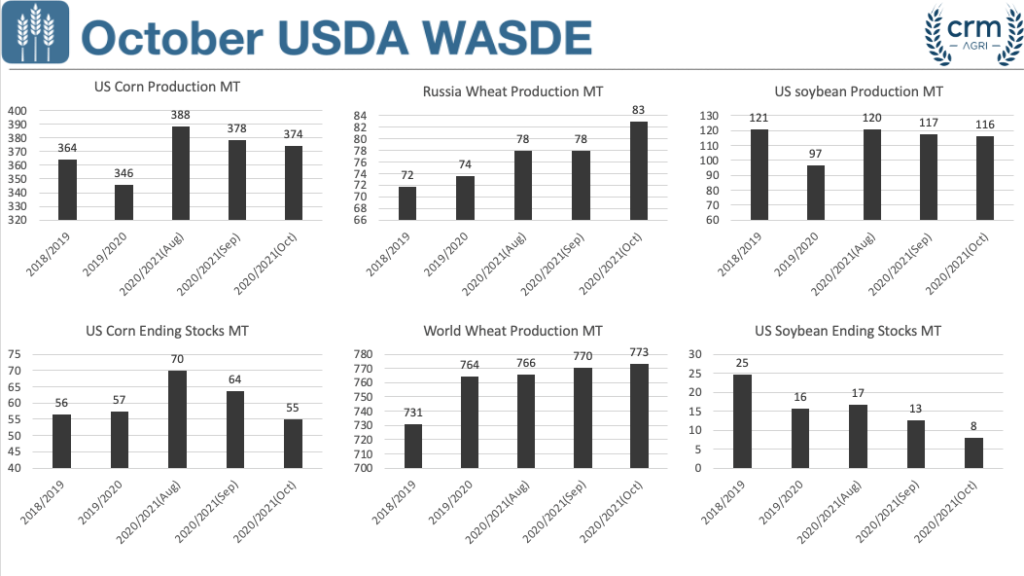

The October USDA WASDE finally upped Russian wheat production estimates to 83MT, in line with market expectations. In addition to the long-awaited increase to Russian production estimates, export forecasts were upped to an expected 39MT.

Looking to the southern hemisphere, production in Argentina and Australia will be of increased importance this season, with the continued decline of wheat in the US and the known issues in Europe.

Australian wheat production estimates were maintained at 28.5MT and confidence in the crop has continued to grow, with potential exports of 19MT, Australian exports are set to double year on year.

However, it isn’t all increases in the southern hemisphere, the outlook for wheat in Argentina has continued to deteriorate. Reduced to 19MT, the USDA production outlook was trimmed by 0.5MT, although still leaves room for further estimate downgrades.

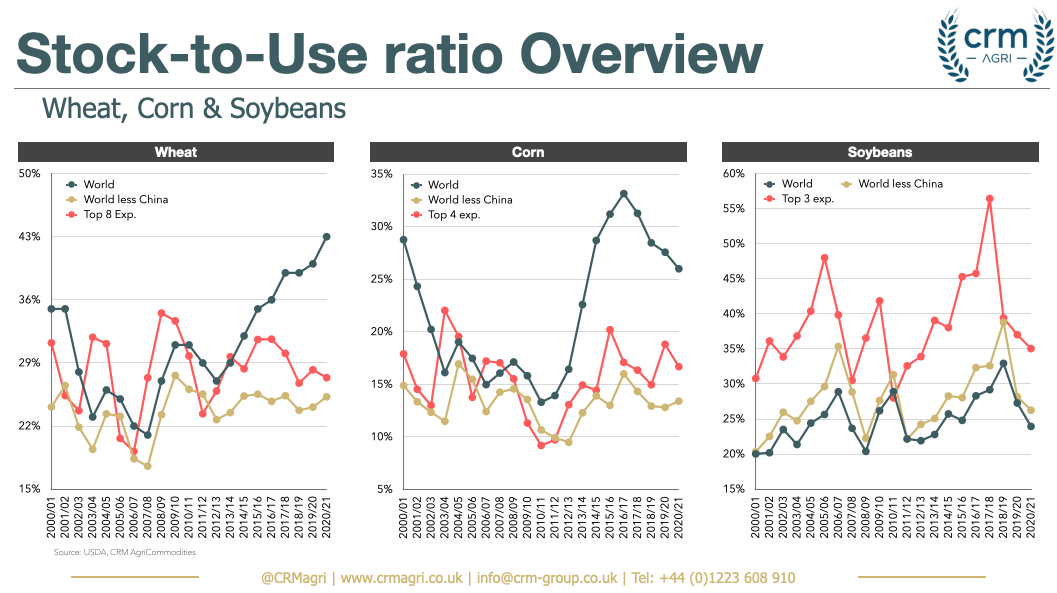

On the whole, on paper wheat supply in in the October USDA WASDE eased slightly, with global ending stocks at 321.45MT increasing to a new record.

Corn / Maize

The October USDA WASDE decreased US beginning stocks to 50.7MT, down from 57.23MT back in September, in line with the expectations from the shock September stock report reductions. US corn production also got trimmed in the October WASDE, down to 373.95MT, back from 378.47MT in September.

With beginning stocks and production trimmed, and only marginal reductions to domestic consumption forecast, 2020/21 US ending stocks have been reduced to 55MT, down 8.5MT from September. The month on month reductions to ending stocks has been the rational for the gains in Chicago corn futures.

However, the global corn story is now at a fork in the road, with the prospects for Brazil the next driver for long term corn markets. Following the devaluation of the Brazilian Real, the increased profitability in Brazil is leading to increased area forecasts, at 19.5MHa, up 1MHa year on year, unchanged from estimates in September maintaining new record production forecasts of 110MT.

Oilseeds & Oil

The October USDA WASDE decreased US beginning stocks to 14.25MT, down from 15.64MT back in September, in line with data and expectations from the shock stocks report.

Production also got trimmed in the October WASDE, down to 116MT, back from 117MT in September, partially due to downward revisions to the harvest area. With beginning stocks, and production trimmed, ending stocks at 7.9MT are substantially down.

Having fallen from 12.5MT in September and 17MT in August, the US soybean marketplace is significantly tighter than estimates made back in the summer, buoyed by the fast pace of export sales to China.

Again, looking to South America, and the importance of Brazil will be critical for the long-term direction in 2020/21. The October USDA estimated Brazil’s soybean production at 133MT in the October WASDE, maintaining estimates for an increase in the planted area as profitability has been boosted by the devaluation of the Real.