Low impact WASDE report

Market movements last week were fairly moot prior to the release of the greatly anticipated USDA World Agricultural Supply Estimates. While the mildly bearish June World Agricultural Supply and Demand Estimates contained few surprises, with the USDA taking a cautious approach as ever, grains came under pressure.

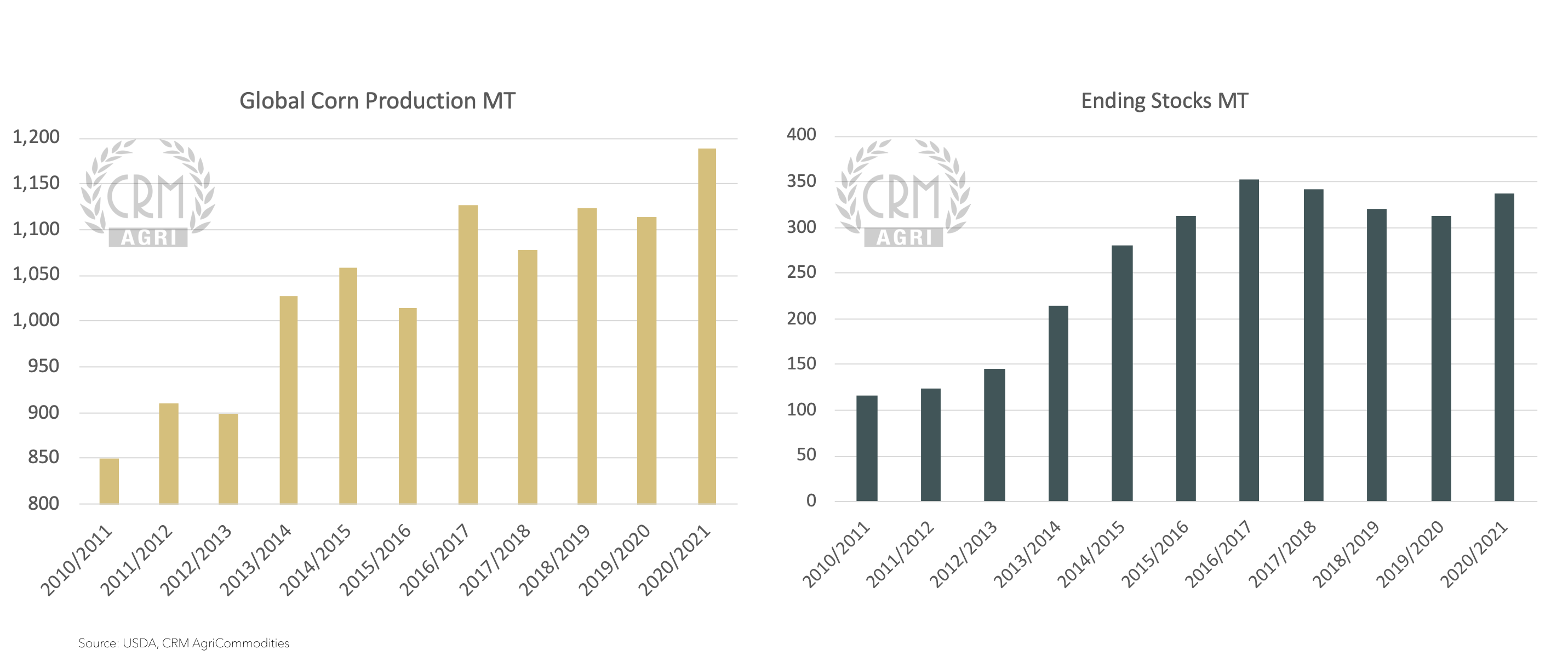

The June estimates raised global maize production in 2020/21 once more to 1188.5MT, up 2MT from the May estimate, however this is still well below the estimates from organisation AMIS at 1207MT, leaving the potential for further increases in supply.

In a further confirmation of the long-term bearish US maize outlook, beginning stocks for 2020/21 have been increased, as further reductions in 2019/20 ethanol demand were factored in. Yet the 2020/21 US consumption outlook remained unchanged with 2020/21 forecasts for US domestic use to bounce back and outstrip 2018/19, which given the global economic outlook and ongoing pandemic seems optimistic, and again leaves room for further cuts.

The June wheat estimates slightly surprised markets, raising the 2020/21 world wheat production outlook to 773.43MT from 768.49MT, and increasing ending stocks by 6MT, taking the wind out of the wheat markets sails.

Major exporters production outlooks were trimmed by 2MT, while Australian production has been revised up 2Mt to 26Mt, this could prove to be overly cautious as Australian organisation ABARES forecasts production to be 26.7MT. The EU and Ukrainian cuts reflected a tightening of available supply but were in line with expectations and offered no support. Overall, deeper cuts will be required to provide meaningful support, and grain markets have since closed lower.

Oilseeds

As the pandemic continues and fears in the US have escalated again with increasing cases, oil markets gave up a lot of the recent support. Brent Crude Has fallen from a high of $42.20/BBL on the 5th June, to close consistently back below $39/BBL as demand fears linger.

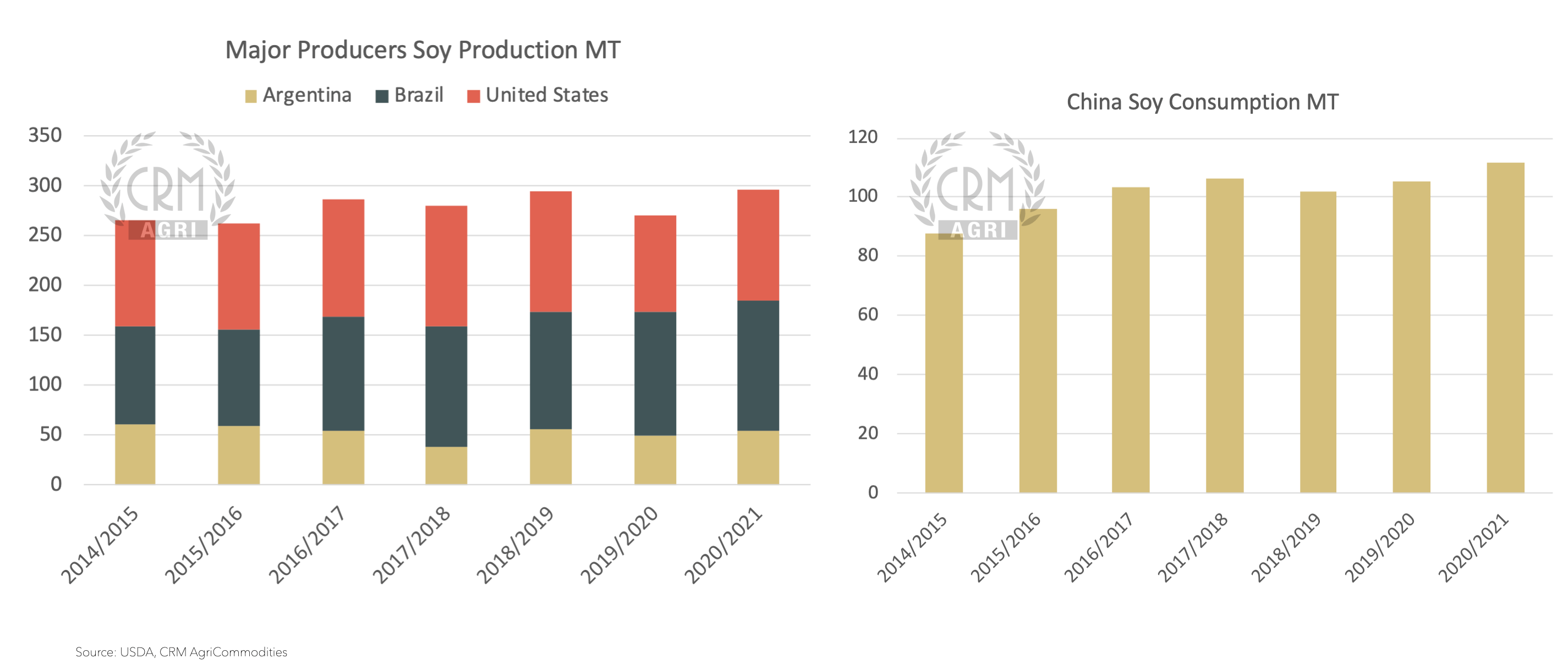

The USDA WASDE also gave little encouragement for oilseed markets last week with global soybean supply and demand little changed from the May outlook. On a global scale, soymeal availability in 2020/21 is expected to increase, from 238MT in 2019/20 to 246MT, with soymeal production in Argentina Expected to reach 33MT, up from 31.35MT in 2019/20.

Expectations that China will import 2MT more soybeans in 2020/21 to fuel the recovery in the pig heard will be closely watched, and any signs of a failure to reach this mark would pressure what remains a well-supplied global market.

Global oilseed rape supply in the second half of 2020/21 is also set to ease slightly, with the Australian canola area set to increase by 32% to 2.4MHa according to Australian organisation ABARES. Additionally, with better conditions, Canola production is forecast to increase by 40% year on year to 3.2MT, back to just 1% below the 10-year average.