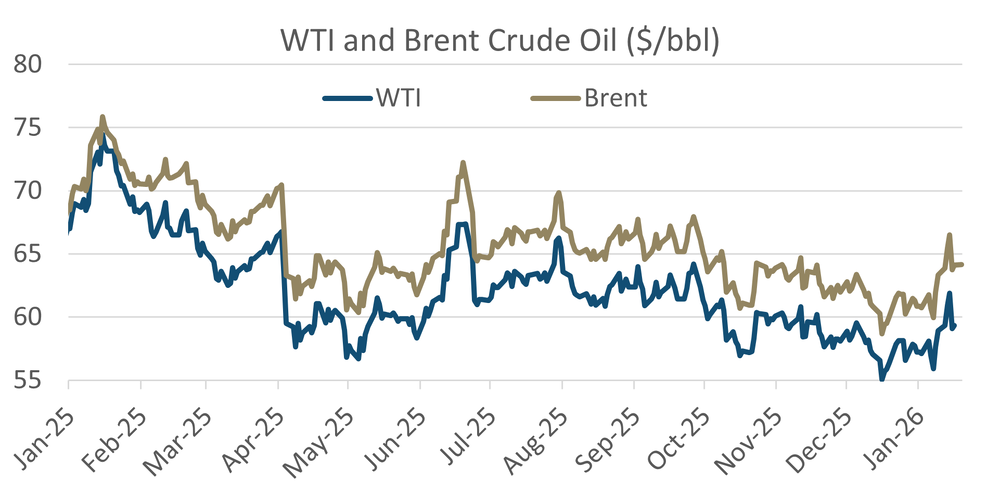

Energy markets & fertiliser - oil and gas outlooks suggest headwinds for Europe's farmers

Opinion20/01/26

Volatile gas prices stall fertiliser prospects in Europe, while the oil market outlook hints at price pressure for biofuel crops

You've hit your free article monthly limit or this article is part of a subscription plan.

Do you want to stay up to date on markets with independent analysis, opinions and data you can trust?

Register or Login to gain access to support your decision making.

👁 Independent analysis & data

📊Leading forecasts

🛢Economic analysis

📈Global physical prices

💻Events & webinars

📲Ask an analyst