January WASDE Key Numbers

| Our full opinions and analysis of the WASDE will be published in next week’s weekly reports, get in touch for subscriptions.

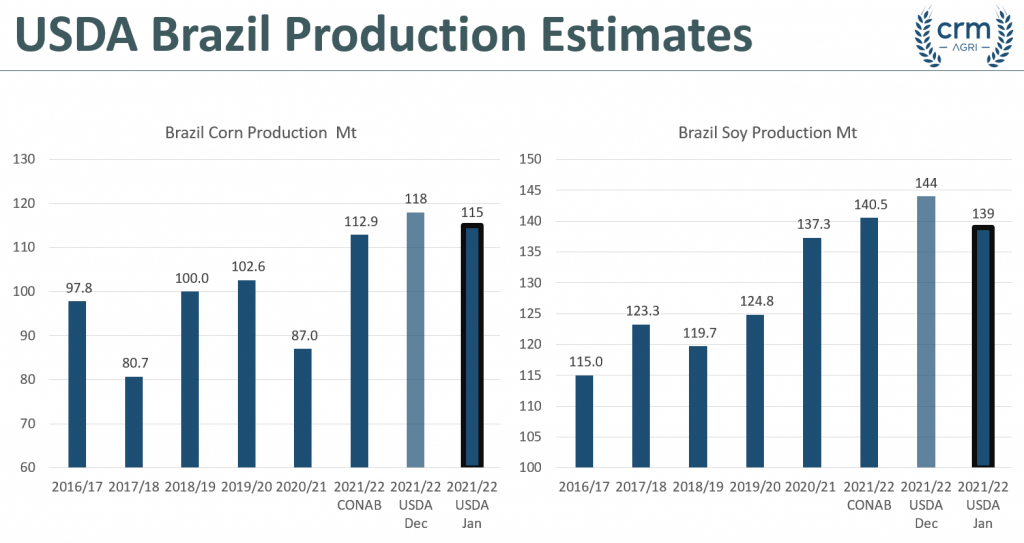

Following the January WASDE, markets have had a mixed reaction, initially falling after the release before recovering. On the whole, a slightly bearish WASDE for corn and wheat with a cautious approach to South American production, while with greater cuts to Soybean production estimates, a cautiously bullish report and start to 2022. Wheat Changes to global wheat supply and demand were fairly minimal in the January WASDE, consisting of slight trims to US consumption estimates, alongside a reduction in Russian export projections, on the whole not a very exciting WASDE for wheat. Corn Changes to corn supply and demand were mostly bearish with an easing of US supply and a cautious approach to South American corn production. US Production estimates were increased from 382.59Mt to 383.94Mt, which alongside reduced export projections, ending stocks were increased from 37.94Mt to 39.11Mt. Chinese estimates were left unchanged, with import projections maintained at 26Mt, but with Ukraine corn production estimates upped to 42Mt, up 2Mt from December, reducing the burden on US supplies. Changes to South American production estimates were limited, with estimates for Argentina at 54Mt only down 0.5Mt from December. In Brazil, production estimates were trimmed to 115Mt, down from 118Mt in December, falling short of CONAB’s view of 112.9Mt, further cuts to come next month? Soybeans Changes to Soy were more aggressive on the whole than for corn, with deeper cuts to South American production estimates and in our view represents a bullish report from a normally conservative USDA. Overall US supply eased slightly in the January WASDE, production estimates were raised slightly to 120.71Mt, up from 120.43Mt in December. With export projections unchanged, ending stocks were raised slightly. In Argentina, production estimates were lowered to 46.5Mt, down from 49.5Mt in December, while in Brazil production estimates were trimmed to 139Mt, down 5Mt from December. The USDA cut production estimates for Brazil further than CONAB, estimating 140.5Mt. |

If you think you can benefit from an independent partner to provide you with forward looking market analysis, opinions forecasts, get in touch. Our analysts are always on hand to answer the key question affecting your business decisions. Get in touch

Receive daily market updates to your inbox | Find out more about our services | Read more articles