EU wheat attempting to find seasonal bottom?

EU wheat is set to post a sixth consecutive week of losses amid a sharp recovery in this year’s soft wheat production, particularly in France ie the largest producer/exporter of the bloc. As such, spot Euronext milling wheat has dropped below the 160€/T mark (~£143.50/T) for the first time since mid-March 2018, forcing farmers to ‘shut the shed’ in expectation of better prices and a seasonal bottom potentially being formed.

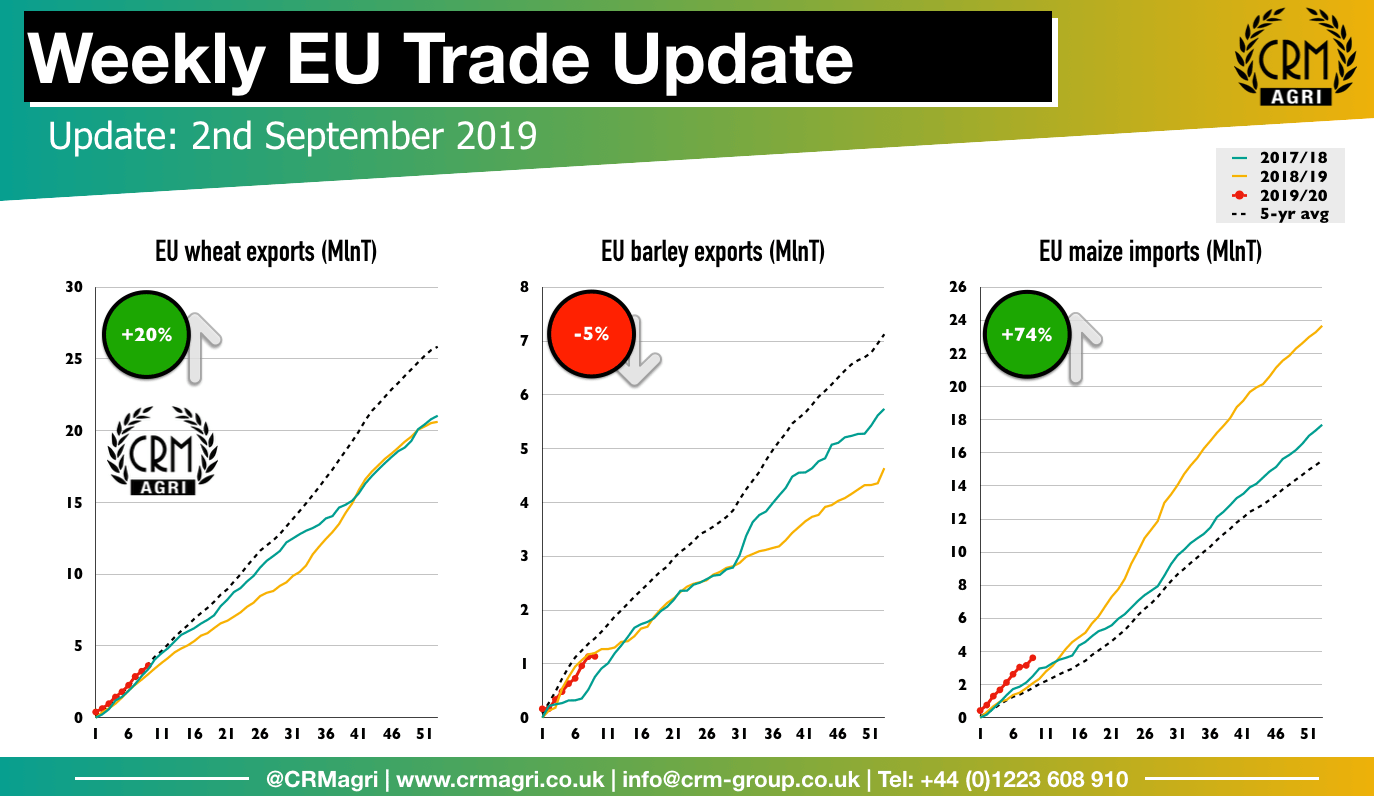

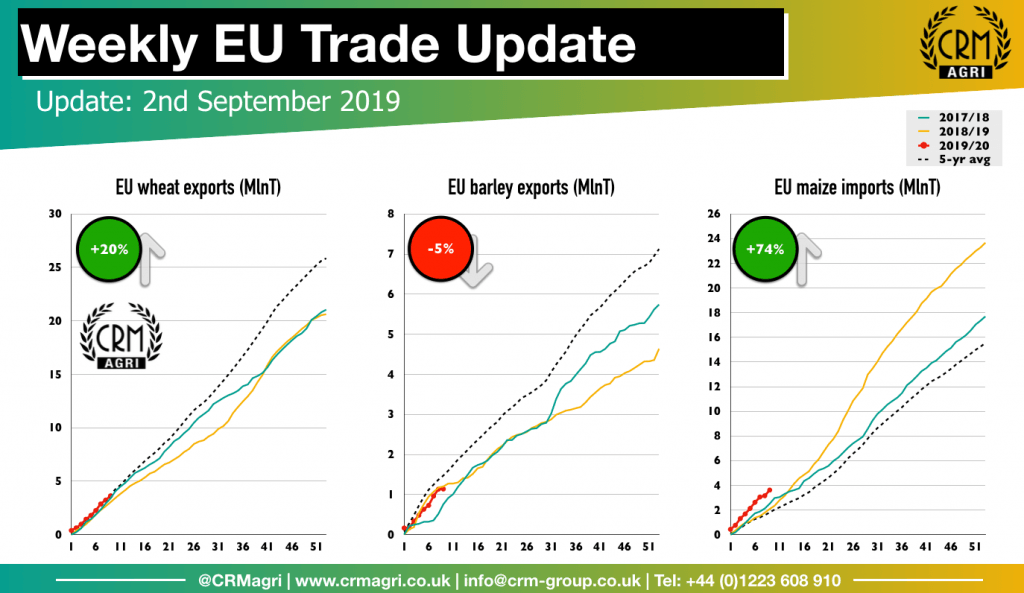

The recent sell-off coupled with the weak euro has greatly improved the competitiveness of the EU origin against the Black Sea, at least on paper. The French port line-up remains robust with the ‘traditional’ wheat exports being observed toward North Africa but some exotic destinations like China is getting attention from the trade with the Asian ogre buying both wheat and barley. As a result, EU wheat exports are picking up, standing at 3.6MMT or +20% on last year but more will be needed to avoid a significant build up in stocks at the end of the season. At the same time, the euro has started to recover against the US dollar, which makes the EU origin priced in USD less attractive on the export market.

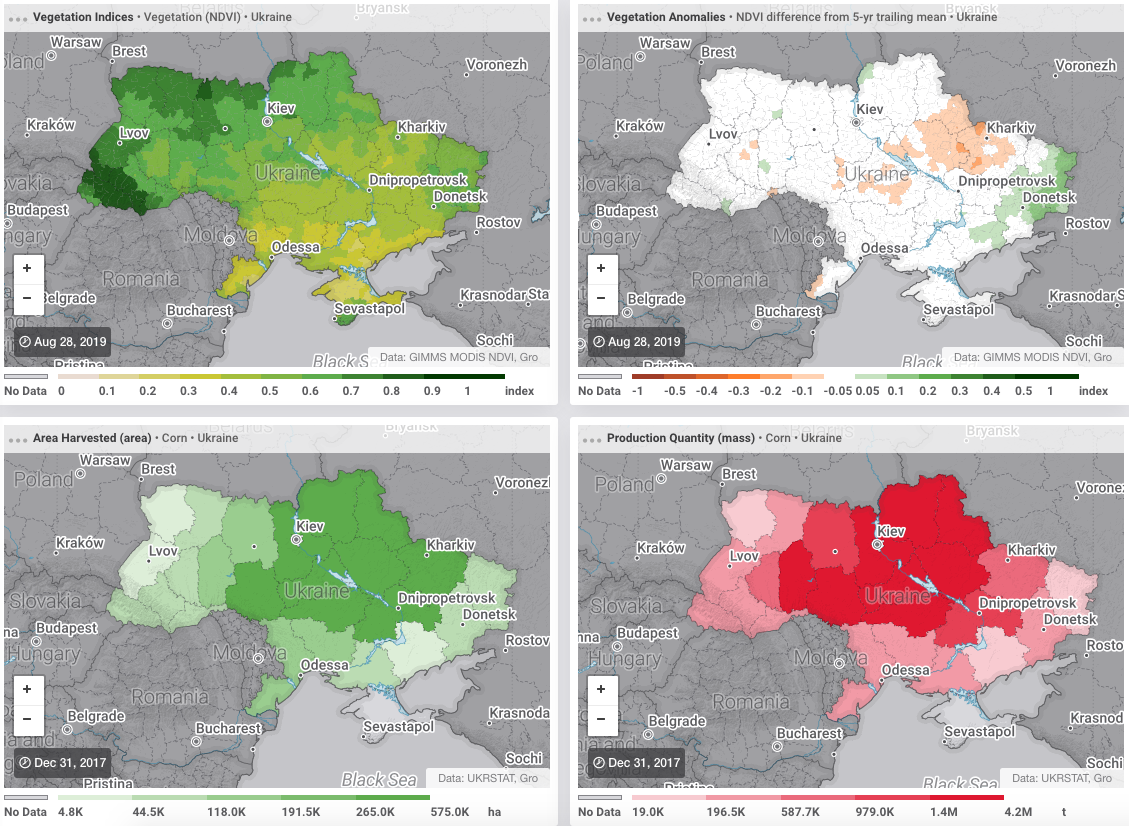

For maize, little fresh news this week: EU imports are still record at 3.6MMT (+1.5MMT on last year) in anticipation of a reduced crop in Western Europe after this summer’s heatwaves somewhat compensated by a good outlook in Eastern Europe and excellent condition in Ukraine.