Brexit and harvest weigh on prices

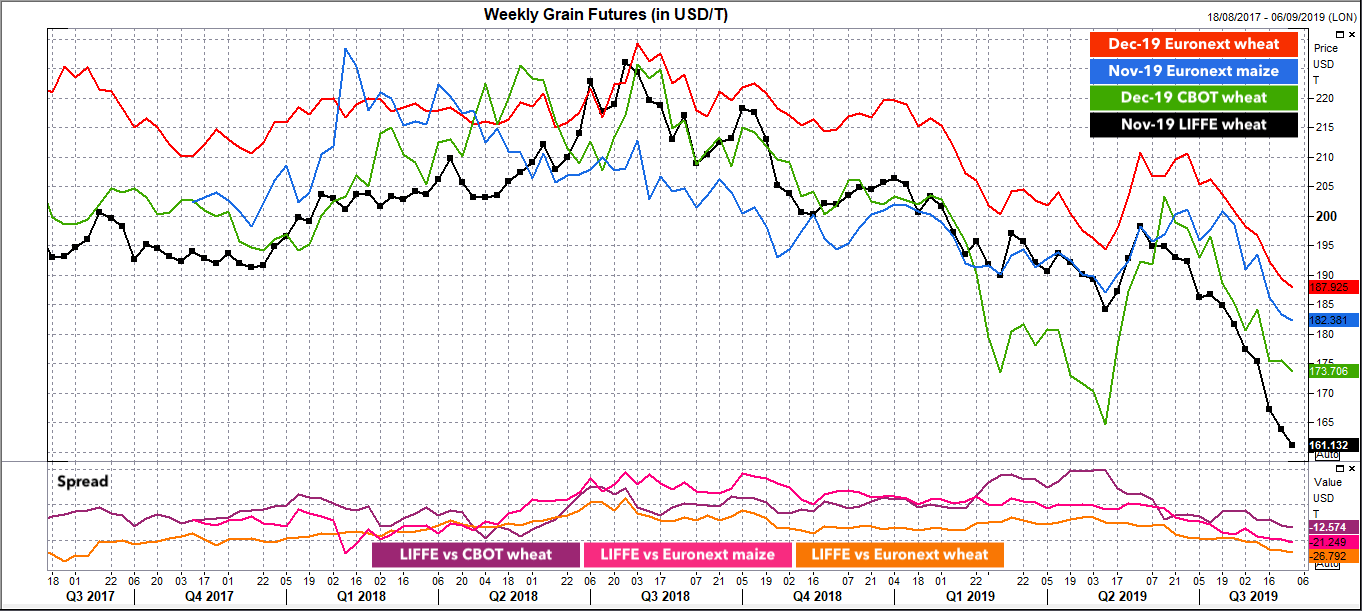

Brexit uncertainty, global depressed markets and harvest pressure continue to weigh heavily on domestic grain prices with the Nov-19 LIFFE feed wheat contract down for a third consecutive week and set to post its biggest monthly loss (10.5% or £15.50/T).

After a frustrating start due to mid-August rain, last weekend’s scorching temperatures have allowed for rapid harvest progress and with higher-than-expected yields in most places, farmers are forced to sell a larger volume than anticipated off the combine due to a lack of on-farm storage. As such, spot wheat trades around the £120/T mark on the physical market with bases deteriorating nationally. Could we see ethanol demand picking up this campaign? Only time will tell.

On paper, UK grains are competitive on the export market but the lack of clarity from a trading perspective with the EU does not bode well for a strong programme as of yet. When futures prices are considered, LIFFE feed wheat trades at a $21/T and $27/T discount to Euronext maize and wheat respectively.

Once harvest pressure is fully digested, historically speaking by mid/end of September, prices could somewhat recover although any rally would be capped by the large feedstuff supply and the potential ‘no deal’ Brexit ending.