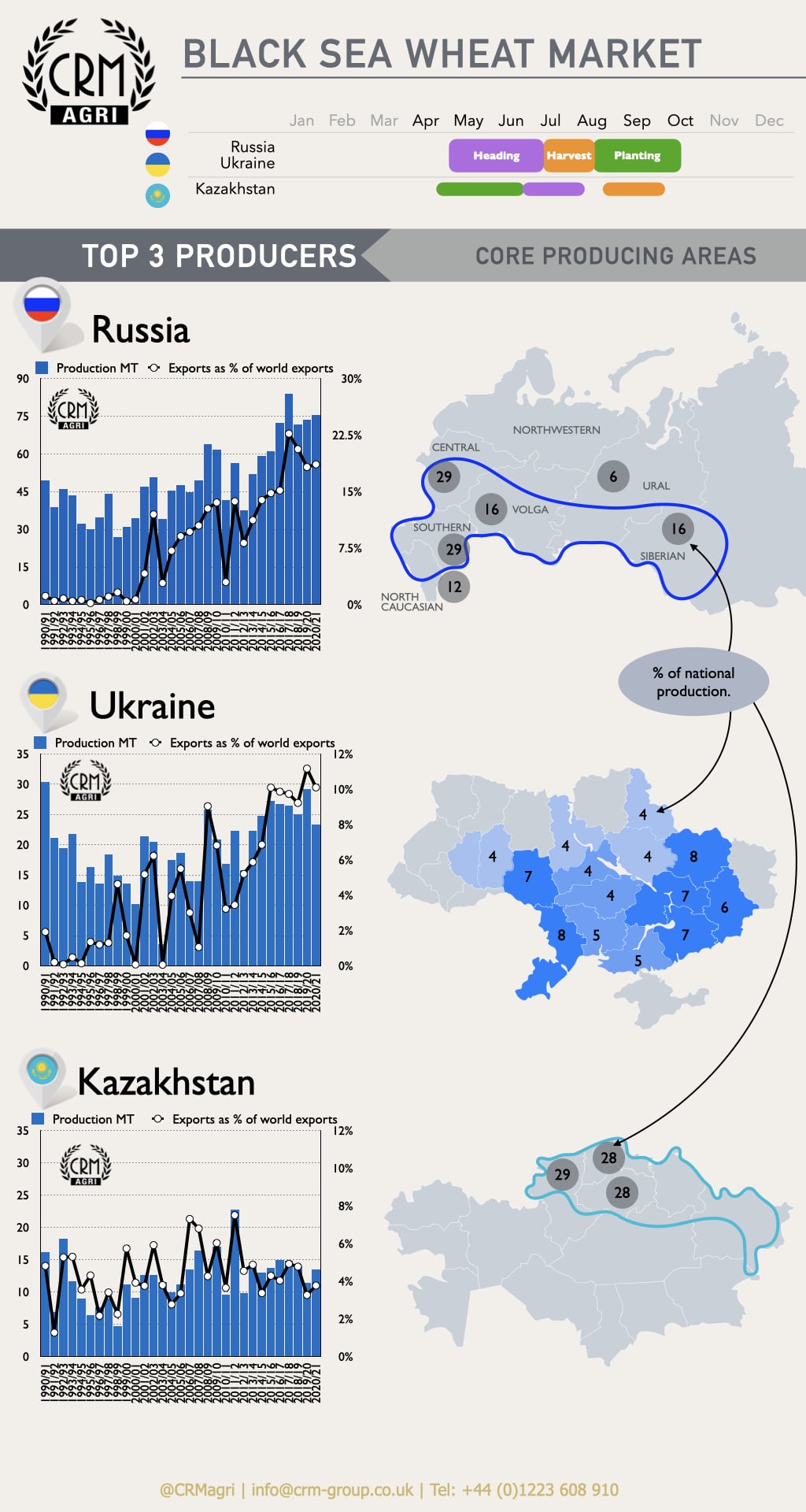

Black Sea Wheat Production

The Black Sea plays an important part in the global wheat market and will likely become the global reference market for wheat in the future as yields and export capacity continue to grow.

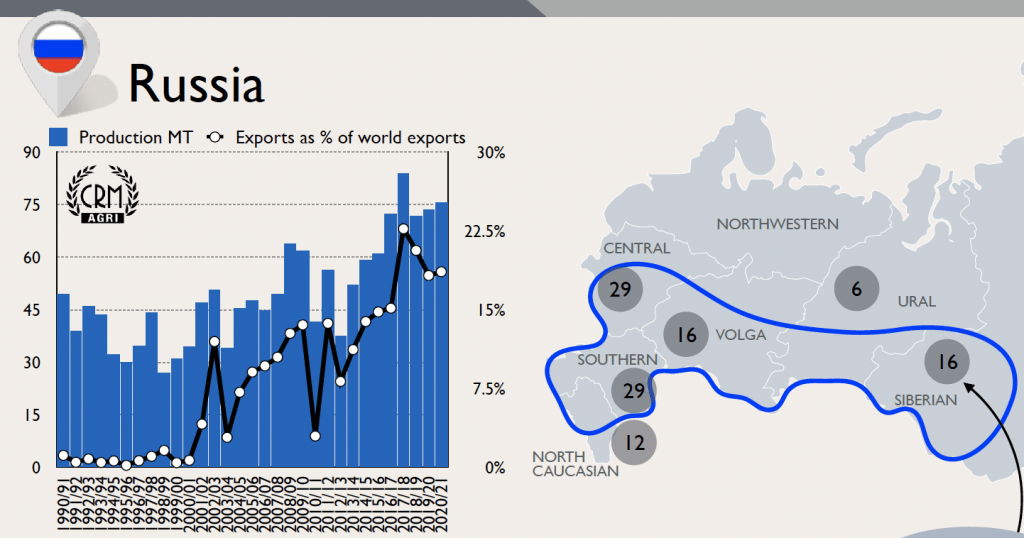

The below infographic highlight the key wheat producing regions, exports as a percentage of world export as well as the key producing area within the main countries of Russia, Ukraine and Kazakhstan. This highlights why markets are so sensitive to weather conditions in these regions and exportable surpluses.

A lack of rainfall during April contributed to yield uncertainty and expectations for yield cuts, not only in the Black Sea but also the EU. Although following the March global wheat market demand driven price spike, markets in general fell back, the yield concerns have provided support to global European markets, preventing markets falling further and fully chasing down new crop maize prices.

Paris milling wheat, and by extension, UK feed wheat futures have received additional support during May as those previous concerns about the dry April in the Black Sea have begun to be better quantified alongside dryness in Europe.

At 28MT, the USDA had previously been a bit optimistic on the conditions in Ukraine and the Black Sea, and now Ukrainian organisations are forecasting 23.3MT wheat crop, which is a significant reduction in the outlook for Black Sea supply. It is expected that winter wheat in Russia will have also suffered, especially in the Southern Region, and there have been multiple reductions in production outlooks for Russia. Yet it is important to note that spring wheat planting in Ukraine and Russia is now verging complete and the weather has turned to favourable. From now on, given a return of rain, the Black Sea outlook is now for assessments of the previous damage and not continued worsening.