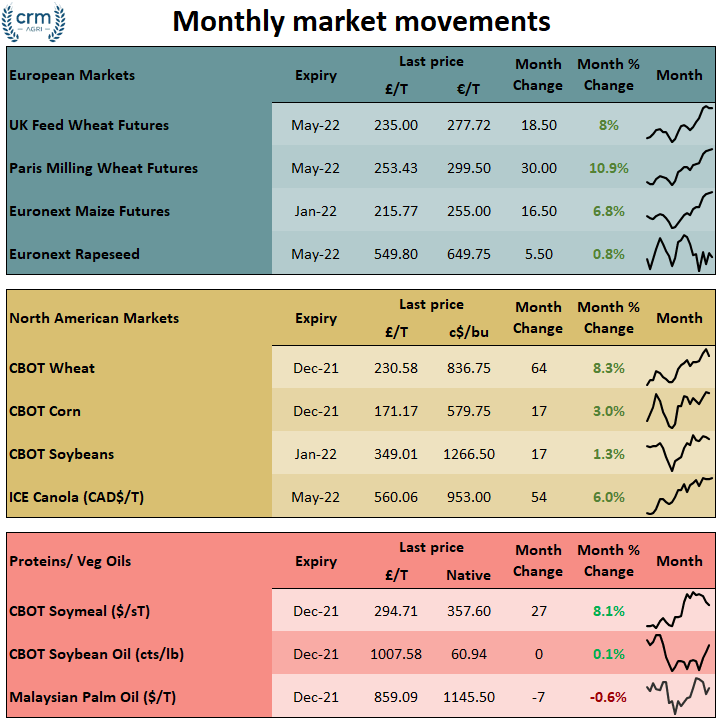

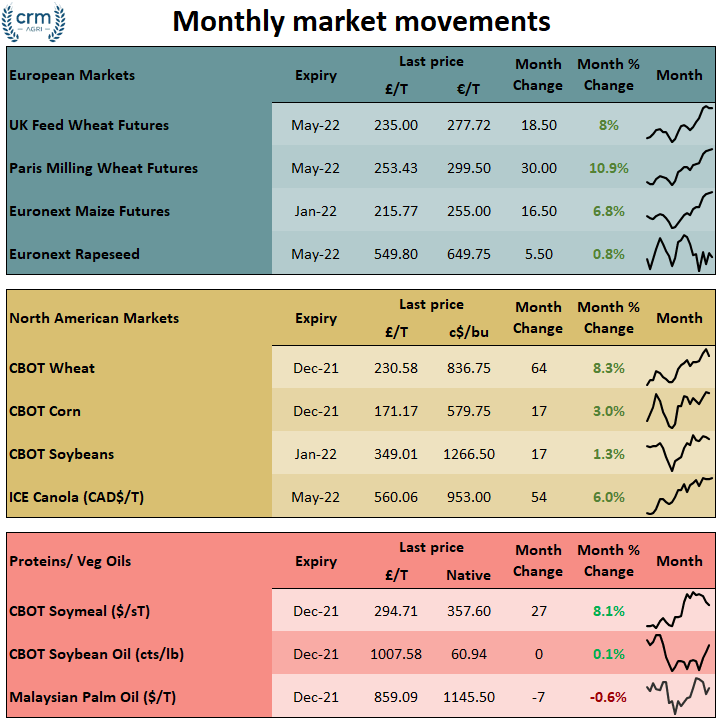

| While global grain markets have been in a bullish mood for a number of months, but partly due to the US Thanksgiving holiday, this week has seen a shift in sentiment with the wheat momentum pausing and oilseed rape back to trading within a relatively tight range.

Adding to the pressure has been a crude oil market sell-off, with concerns about new Covid variants leading to a fall in global stock indices and crude oil, which has traded back below $80/bbl once more.

With the US harvest now complete, demand will become the main driver of markets. China remains the known unknown for grain markets this season, keep a close eye on US export sales and Chinese import projections and news. The next WASDE will be released on the 9th of December.

Supply from South America is the next immediate driver for supply, where La Nina conditions prevail with some dryness in Argentina, with weather during the corn pollination window important for yield prospects, rainfall in Argentina and Brazil will become an increasing focus in the coming weeks and months.

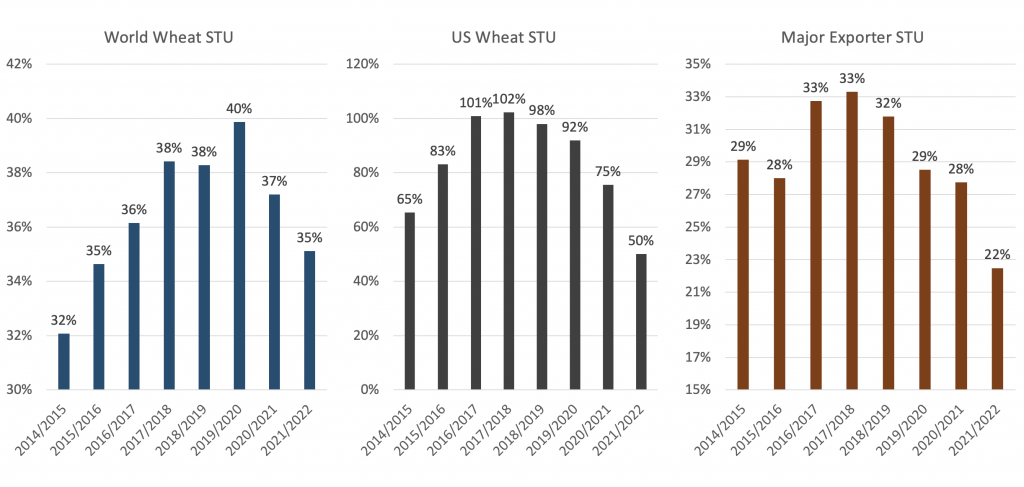

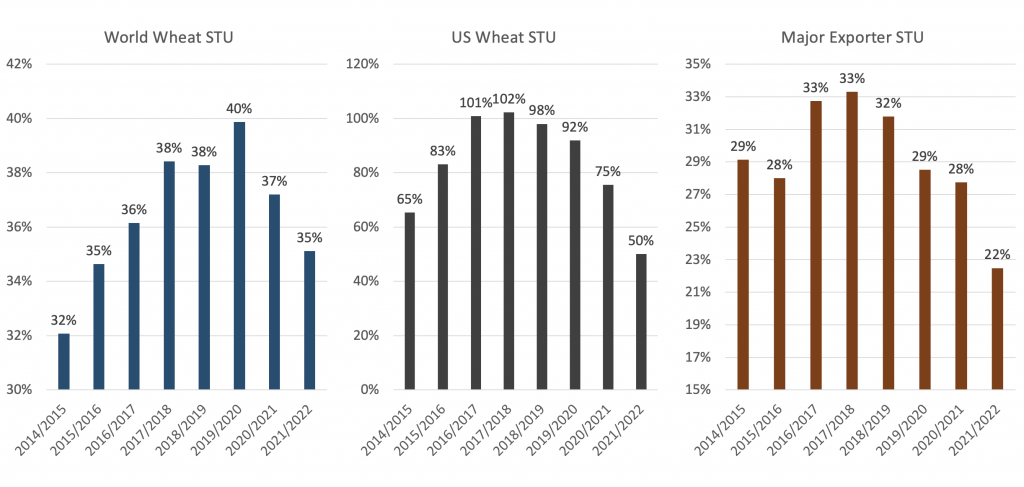

With global stock to use ratios so tight, a key driver for wheat this winter will be winter kill, Russia suffered badly from winter kill last year, and with the ongoing political intervention in exports markets, concerns for supply next season have the potential to further stock export supply fears.

Defra/AHDB has released the first official balance sheet for 2021/22, find it here, we will cover the key numbers and provide our analysis and opinion on the data and implications in our Monday Grain Market Outlook report. |